With Over 500+ Business Transformed,

We’re One Of The Fastest Growing Investment Banks In The World

Check out the 500+ businesses we’ve transformed.

HVAC

HVAC

Pest Control

Pest Control

MedSpa

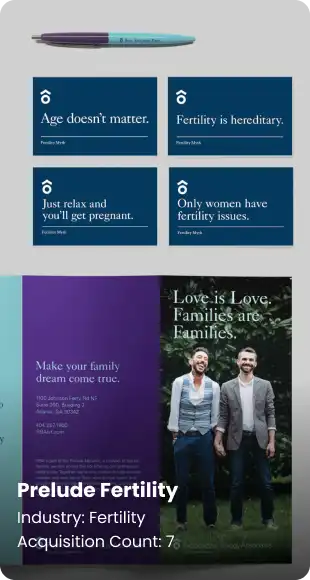

Fertility Clinic

For over a decade, we have been in your shoes.

Oliver Bogner, our Founding Partner

is a 2x  CEO, and a 2x

CEO, and a 2x  who has previously sold five of his own

who has previously sold five of his own

companies to strategic purchasers, private equity firms, and family offices.

He founded The Advisory to help business owners turn transactions, into transformations. He has built a modern M&A playbook that every business goes through, and results in the ultimate value creation.

Our clients get direct access to the most active private equity buyers in their industry. Regional business brokers sell to local market players and SBA backed buyers, we sell exclusively to Private Equity buyers willing to pay the highest price. We are a New York based investment bank working with institutional buyers only, not a local business broker.

We will present your business to a diverse group of highly qualified private equity firms, and private equity-owned platforms. Most likely, your buyer will be one of the 4,500+ private equity companies who own “platforms” in your sector and are seeking for “add-ons”, or private equity firms looking to launch a new “platform,” and have your business as the anchor business.

Explore some of the most active private equity owned platforms in your industry, and create a competitive bidding war to maximize valuation. We have deep relationships at every major platform, and analyze every move they make.

A “platform” is often a larger firm in your sector with $20+ million or more in revenue and $5+ million or more in EBITDA that seeks to acquire similar businesses in new geographies or specialties to get bigger.

An “add-on” acquisition is a strategy where a private equity firm or other buyer purchases a smaller company to merge it with an existing company, or “platform”. The goal is to add value to the platform company, create growth, and get bigger. Add-on acquisitions are a common strategy in private equity and have accounted for over 60% of all private equity transactions in recent years. Typical “add-ons” can range in size from $250K – upwards of $10+ million in EBITDA. Typically the minimum size to be an “add-on” is at least $1M in adjusted EBITDA.

Use our team to gain access to the best network of private equity buyers in the world.

2X

Forbes 30 Under 30 Founding Partner

3

Offices

2X

Inc. 5000 Founding Partner

FINRA

Licensed Investment Banker

500+

Companies Transformed

4.5K+

Access to Private Equity Firm Relationships In The US

4-6

Month Average Time For Completed Transaction

62K+

Access to Platforms Backed By Private Equity Firms In The US

See what has everyone talking, and how selling your business to private equity can lead to a transformational transaction.

Fox Business

the wall street journal

Discover the team that understands your unique industry and knows how to maximize value.

Medical Services

Plastic Surgery

Urology

Gastroenterology

Vein & Vascular Specialists

Ophthalmologist

Skilled Trade

Foundation Repair

Door Repair

Demolition

Septic

Consumer Services

Armed Guard

Commercial Glass and Glazing

Stone, Tile, Marble

Recreational Vehicle Services

Lumberyard

Demand more from your investment bank, and grow your business with an investment bank that isn’t afraid of making the old guard uncomfortable.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.