With Over 500+ Business Transformed,

We’re One Of The Fastest Growing Investment Banks In The World

We breakdown M&A and simplify the entire process for operators & founders. We’re here to help guide you every step of the way.

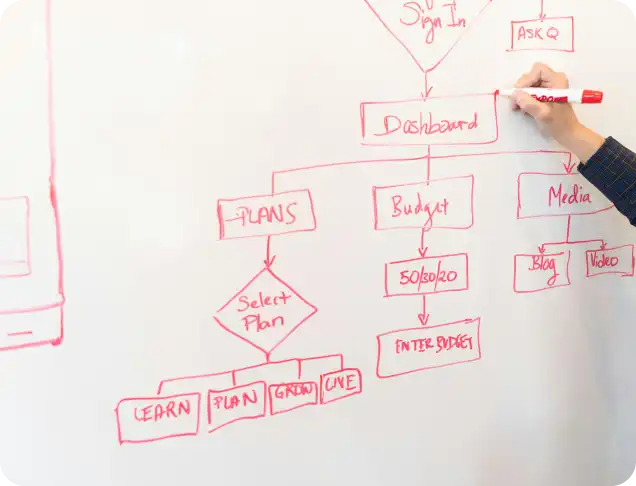

Our journey together begins with a confidential consultation to discuss your selling goals, timeline, and any particular needs or concerns. This meeting is crucial for crafting a customized strategy that aligns with your specific objectives.

We conduct a comprehensive valuation of your business, employing both industry-standard and innovative methodologies. This dual approach ensures your business’ financial performance and unique attributes are accurately represented in its valuation.

Our team meticulously crafts your business’ market positioning, emphasizing its unique selling points to attract the ideal buyers. Through strategic marketing, we ensure your business shines in the competitive landscape, all while upholding the utmost confidentiality.

We create compelling marketing materials that highlight the key aspects of your business, designed to resonate with potential buyers. This includes detailed financial data, information packets, executive summaries, and other collateral that showcase your business’ unique value proposition.

Leveraging our extensive network, we identify prospective buyers who are not only interested but are also a strategic fit for your business. Our rigorous screening process ensures that only financially capable and serious buyers proceed.

We facilitate presentations and meetings between you and potential buyers, ensuring a smooth and productive exchange of information. This step is crucial for finding a buyer whose vision aligns with the future you imagine for your business.

Our seasoned negotiators work on your behalf to secure the best possible terms. We guide you through each offer, providing clarity and advice to help you make informed decisions that align with your goals.

During the due diligence phase, we ensure a seamless information exchange between you and the buyer, addressing any concerns swiftly to maintain momentum towards closing.

The closing marks the culmination of this process. We manage the finalization of sale documents and the transfer of ownership, ensuring a smooth transition that honors your business’ legacy and its future potential.

We ONLY get paid, when YOU GET PAID. We are NOT a business broker. We ARE a FINRA registered investment bank. We ONLY sell businesses to institutional investors. We DO NOT SELL to individual investors that need SBA Financing, or owner Financing. Our institutional buyers typically pay ALL CASH.

There is NO MONTHLY RETAINER FEE, and NO BREAKUP FEE. If you PASS ON THE FINAL DEAL, there is no penalty fee. We do require to be your exclusive investment bank, and we do require you to be actively involved in the sales process. When your deal closes, you pay a success fee that is a percentage of what you receive on closing day! Seems simple? It is!

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.