The Advisory Investment Bank is the premier partner for middle-market businesses in the Environmental Services sector, with a specific focus on mold, fire, and water remediation. Our proven expertise, deep industry understanding, and tailored approach have helped business owners achieve exceptional outcomes in this fast-growing and essential industry.

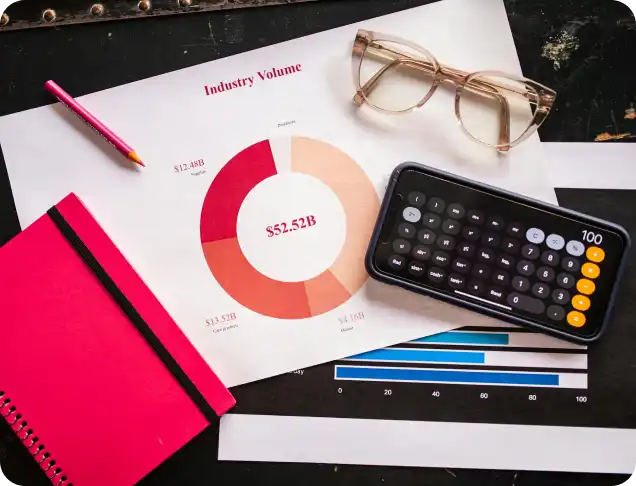

Check out our latest in depth report on your industry

We understand the unique challenges and opportunities within the Environmental Services sector. From responding to rising demand for property restoration due to natural disasters and aging infrastructure to navigating strict environmental regulations, our team has the insight to position your business for success.

We maintain relationships with leading private equity firms and strategic acquirers actively seeking investments in the mold, fire, and water remediation industry. Our ability to connect you with the right buyers ensures you achieve the best valuation and deal structure for your business.

The Environmental Services industry offers strong fundamentals that are highly attractive to investors, including:

We are dedicated to serving middle-market businesses, providing personalized attention and tailored strategies that larger investment banks simply can’t match. Our team works closely with you to align your strategic goals with market opportunities, whether you’re pursuing growth, recapitalization, or an exit.

With a history of successful transactions in the Environmental Services sector, we have demonstrated our ability to deliver optimal outcomes. From valuation and deal structuring to negotiations and closing, we provide unmatched expertise and execution at every stage of the process.

Private equity firms are increasingly interested in the Environmental Services sector, specifically mold, fire, and water remediation, due to its strong growth potential, essential nature, and opportunities for operational improvements. Here are five key reasons why private equity investors find this industry attractive:

The increasing frequency of natural disasters such as floods, wildfires, and storms, combined with the growing effects of climate change, has led to a sustained rise in demand for remediation services. The industry offers growth opportunities driven by both emergency response needs and ongoing damage repair for residential, commercial, and industrial clients.

Environmental remediation services are crucial for health, safety, and property preservation, making them indispensable to communities and businesses. These services remain in demand regardless of economic cycles, as property damage repair and mitigation are non-discretionary expenses, offering private equity firms a resilient investment with stable cash flows.

The Environmental Services sector is highly fragmented, with many small to mid-sized companies operating regionally. This presents private equity firms with opportunities for buy-and-build strategies, where they can acquire multiple smaller players, consolidate operations, and create a larger, more efficient, and scalable platform. This strategy drives synergies and enhances overall value.

Many businesses in the remediation space operate on a combination of emergency services and long-term maintenance contracts, creating recurring revenue streams. Additionally, companies often develop strong relationships with insurance providers, property managers, and municipalities, ensuring steady business and customer loyalty, which is highly attractive to private equity investors seeking predictable cash flows.

There is growing potential for innovation within the Environmental Services industry. Private equity firms are interested in businesses that can leverage technology to improve operational efficiency, enhance service delivery, and reduce costs. Whether through advanced drying technology, mold detection tools, or improved logistics and customer management systems, businesses that embrace innovation are well-positioned for growth and profitability.

If you’re looking to attract private equity investment for your Environmental Services business—whether in mold, fire, or water remediation— it’s essential to focus on the factors that private equity firms prioritize. Here are five key things to consider to make your business more appealing to potential buyers:

Private equity investors are highly attracted to businesses with predictable and consistent revenue. Focus on:

Private equity firms want to see that your business has room to grow. To showcase scalability, you should:

Operational efficiency directly impacts profitability, making it a key focus for private equity investors. Ensure your business is operating efficiently by:

Private equity investors prefer businesses that are well-managed and compliant with regulations. To build investor confidence, focus on:

Private equity buyers look for businesses with strong leadership capable of sustaining growth and driving operational improvements. To strengthen your management team:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.