The Advisory Investment Bank has established itself as the premier advisor for middle-market businesses in the Roofing industry. Our proven expertise, industry-specific insights, and unparalleled network of buyers make us the trusted partner for roofing business owners seeking growth, consolidation, or a strategic exit.

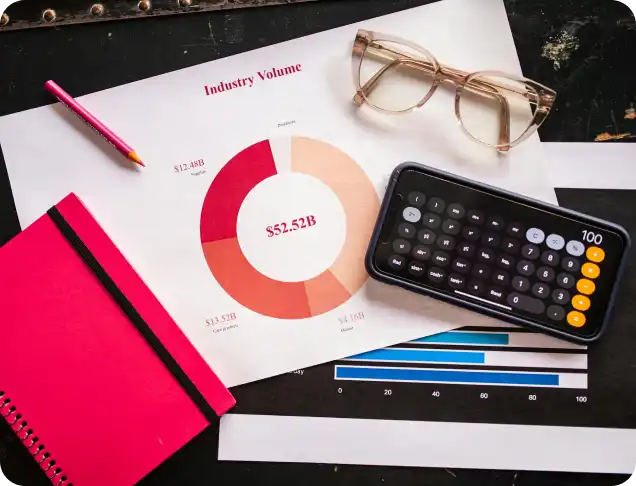

Check out our latest in depth report on your industry

We have a thorough grasp of the roofing sector’s unique dynamics, including:

This expertise allows us to position your business effectively in a competitive market.

Our extensive relationships with strategic buyers, private equity firms, and institutional investors give us the ability to connect you with partners who understand the value of your roofing business. Whether you’re looking to grow, merge, or sell, we ensure your business reaches the right audience.

We specialize in showcasing the strengths that make your business attractive to potential buyers, such as:

Our approach maximizes your valuation and ensures a favorable transaction outcome.

Roofing businesses often face unique challenges and opportunities. Our tailored solutions are designed to meet the specific needs of middle-market companies, ensuring:

The Advisory Investment Bank has a history of success in service-driven industries, including roofing. From negotiating complex deals to securing premium valuations, our team has consistently delivered exceptional results for our clients.

The Roofing industry has emerged as an appealing investment opportunity for private equity firms due to its resilience, growth potential, and recurring revenue opportunities. Here are five key reasons why private equity is drawn to this sector:

Roofing is a critical component of property maintenance and construction. Whether for residential, commercial, or industrial properties, roofing services are non-discretionary, ensuring steady demand regardless of economic cycles. Private equity firms value this industry’s resilience and consistent revenue streams.

The roofing industry is highly fragmented, with many small to mid-sized operators serving localized markets. This presents significant opportunities for private equity firms to implement buy-and-build strategies, consolidating smaller businesses into larger, more scalable platforms to achieve operational efficiencies and expand market share.

Roofing businesses often generate recurring revenue through maintenance contracts, warranty services, and regular inspections. These predictable income streams provide stability and are highly attractive to investors looking for consistent cash flows.

The increasing adoption of energy-efficient roofing systems and sustainable materials is driving growth in the industry. Private equity firms see this as an opportunity to invest in companies at the forefront of this trend, capitalizing on rising consumer and regulatory demand for eco-friendly solutions.

Roofing businesses benefit from recurring opportunities tied to storm damage repair and insurance-funded projects. The frequency of extreme weather events and the reliance on roofing companies for post-storm restoration make the industry a reliable and profitable investment avenue.

If you’re considering private equity investment or preparing your Roofing business for a strategic sale, it’s essential to focus on key factors that drive value for potential buyers. Here are five critical areas to prioritize:

Private equity buyers value businesses with predictable and consistent cash flow. To enhance this aspect:

Private equity firms look for businesses with strong growth prospects. To showcase scalability:

Clear and transparent financials are essential for attracting private equity buyers. To strengthen your position:

Private equity firms value businesses with strong leadership and a capable team. To enhance this aspect:

To stand out in a fragmented industry, emphasize what makes your business unique. Consider:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.