The Advisory Investment Bank is the trusted partner for middle-market businesses in the Pest Control industry, offering unmatched expertise and proven success in navigating complex transactions. Our deep industry knowledge, strategic approach, and extensive network make us the go-to advisor for companies seeking growth, investment, or exit opportunities.

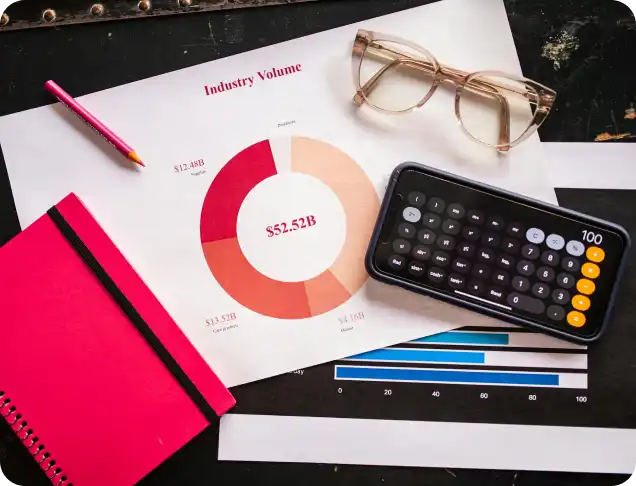

Check out our latest in depth report on your industry

We understand the unique dynamics and complexities of the orthopedics industry, including:

Our industry knowledge enables us to identify opportunities that maximize the value of your business.

With strong relationships across private equity firms, healthcare-focused investors, and strategic acquirers, we connect you with the right partners to achieve your goals. Whether you’re seeking capital to expand, planning a merger, or preparing for a sale, we ensure your business is presented to buyers who recognize its full potential.

We excel at showcasing the factors that make your orthopedic practice or business attractive to investors, including:

As a middle-market specialist, we understand the unique challenges and opportunities facing orthopedic practices. Our customized solutions ensure:

The Advisory Investment Bank has a history of delivering exceptional results for healthcare businesses, including orthopedic practices. From negotiating complex transactions to navigating regulatory considerations, our team has the expertise to handle every aspect of the deal process.

The Orthopedics industry is a compelling investment opportunity for private equity firms due to its strong growth drivers, scalability, and alignment with long-term healthcare trends. Here are five key reasons why private equity is drawn to this dynamic sector:

The aging population and an increase in musculoskeletal conditions are fueling demand for orthopedic care. As life expectancy rises, more patients require joint replacements, spinal care, and other orthopedic services, ensuring a growing and stable market.

Private equity firms see significant value in the trend toward outpatient surgical centers, which offer cost-effective, patient-friendly alternatives to hospital-based care. These centers are scalable, profitable, and align with broader healthcare trends, making them highly attractive to investors.

The orthopedics industry is at the forefront of innovation, including:

Private equity investors are eager to back companies that lead in adopting and commercializing these advancements.

The orthopedics industry is highly fragmented, with numerous small and mid-sized practices. This creates opportunities for roll-up strategies, where private equity firms consolidate multiple practices to achieve operational efficiencies, expand geographic reach, and increase market share.

Orthopedic practices often benefit from recurring revenue streams through post-operative care, physical therapy, and long-term patient relationships. Combined with relatively high margins in specialized procedures, this provides private equity firms with predictable cash flows and attractive returns.

If you’re preparing your Orthopedics business for private equity investment, it’s essential to focus on key factors that appeal to potential buyers. Here are five critical areas to prioritize:

Private equity buyers value businesses with stable and diversified revenue. To enhance this aspect:

Efficient operations and the potential for growth are crucial. To improve scalability:

Private equity firms are drawn to businesses that stay ahead of the curve with innovative technologies. To stand out:

A practice with a talented and experienced team is more attractive to investors. To showcase this strength:

Private equity firms want to see a business with a vision for the future. To demonstrate potential:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.