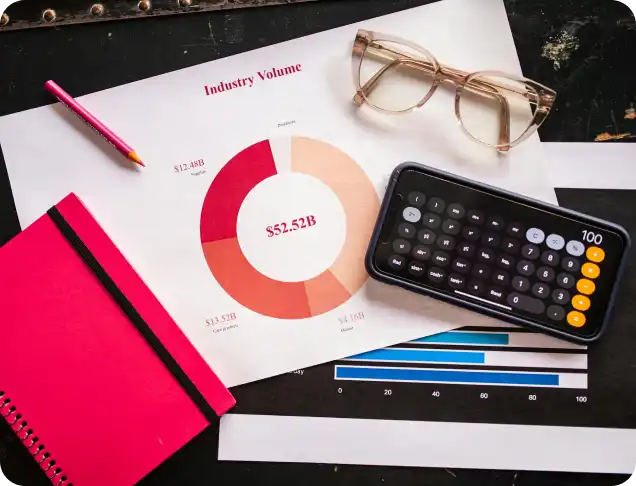

The Vacation Rental Property Management industry has experienced remarkable growth, driven by the rise of short-term rental platforms and evolving consumer preferences for unique travel experiences. As the leading middle-market investment bank for this sector, The Advisory Investment Bank is perfectly positioned to help property management businesses capitalize on this trend and maximize their value. Here’s why we are the trusted partner in this dynamic market:

Check out our latest in depth report on your industry

With years of expertise in the vacation rental property management industry, we are uniquely equipped to guide businesses through the complexities of the market. Our team understands:

Our in-depth industry knowledge ensures that we can help businesses make informed strategic decisions that maximize growth and value.

The vacation rental industry is fragmented, with many regional players and opportunities for consolidation. At The Advisory Investment Bank, we specialize in:

We have built strong relationships with private equity firms, venture capitalists, and strategic investors who are focused on the vacation rental market. Whether you are looking to:

Our network enables us to connect you with the right investors, positioning your business for long-term success and value creation.

Vacation rental property management businesses often benefit from economies of scale. The Advisory Investment Bank works closely with clients to identify opportunities for expansion, including:

From initial valuations to final negotiations, The Advisory Investment Bank offers a full suite of transaction services to support your business throughout the deal-making process. This includes:

The Vacation Rental Management industry has become a focal point for private equity investment due to its robust growth potential and evolving market dynamics. Here are five key reasons why private equity finds this sector particularly appealing:

The rise of platforms like Airbnb, Vrbo, and Booking.com has revolutionized the vacation rental market, creating unprecedented demand for professionally managed properties. With consumers increasingly favoring unique, short-term rental experiences over traditional hotels, private equity sees the opportunity to capitalize on this growing trend.

Vacation rental management companies often operate on a commission-based model, earning recurring revenue from property owners. With relatively low fixed costs, the business model provides attractive profit margins. This consistent cash flow appeals to private equity investors looking for reliable returns.

The vacation rental management industry is highly fragmented, with numerous small and regional players. Private equity investors see significant opportunities to consolidate these businesses, creating larger, more efficient operations with stronger brand presence and market share. This “roll-up” strategy can unlock operational efficiencies and drive economies of scale.

Technology is transforming the vacation rental industry, from dynamic pricing algorithms to AI-powered guest services and automated booking platforms. Private equity is drawn to companies leveraging technology to optimize operations, enhance customer experience, and increase profitability. The scalability of tech-enabled businesses further enhances their appeal.

As global travel continues to rebound and grow, especially in emerging markets, the demand for vacation rentals is expected to rise. Private equity investors are eager to back businesses that can tap into these expanding markets, diversify property portfolios, and adapt to changing travel trends, such as the popularity of eco-friendly and luxury stays.

If you’re looking to attract private equity investment for your Vacation Rental Property Management business, it’s crucial to position your company as a scalable, profitable, and innovative operation. Here are five key considerations to ensure your business stands out to potential buyers:

Private equity buyers value businesses with a diverse portfolio of managed properties that reduces dependency on any single market or client. To maximize appeal:

A predictable and consistent revenue stream is a top priority for private equity investors. To enhance your business’s attractiveness:

Technology is a critical differentiator in the vacation rental management industry. To appeal to private equity:

A recognizable brand with a loyal customer base makes your business more valuable. Ensure your business stands out by:

Private equity buyers expect clear and accurate financial reporting to assess a business’s health and potential. Prepare for scrutiny by:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.