The Plumbing Industry is essential, resilient, and increasingly dynamic, driven by technological innovation, sustainability initiatives, and market consolidation opportunities. The Advisory Investment Bank has established itself as the go-to partner for plumbing businesses seeking growth, investment, or exit opportunities. Here’s why we are the trusted advisor in this sector:

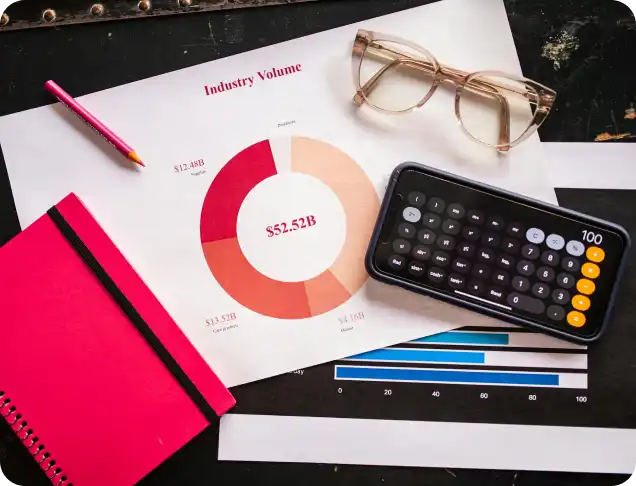

Check out our latest in depth report on your industry

Our team has unparalleled knowledge of the plumbing industry, from traditional services to emerging trends like smart plumbing systems and water-efficient solutions. We understand:

This expertise allows us to provide tailored advice and strategies for maximizing business value.

We specialize in navigating the complexities of middle-market transactions, including mergers, acquisitions, and capital raising. Our experience ensures:

We maintain robust relationships with private equity firms, strategic buyers, and institutional investors who are actively seeking opportunities in the plumbing sector. Our network enables us to:

We guide plumbing businesses in showcasing their operational strengths and financial stability, ensuring they are well-positioned for investment. This includes:

At The Advisory Investment Bank, our goal is not just to close transactions but to help our clients build sustainable, long-term value. We provide strategic insights that enable plumbing businesses to thrive in a competitive market and stand out to potential investors or buyers.

The Plumbing Industry has become a target for private equity investment due to its essential nature, growth potential, and opportunities for value creation. Here are five reasons why private equity finds this sector particularly appealing:

Plumbing is a critical service industry, driven by the ongoing need for repair, maintenance, and new installations. Key factors contributing to consistent demand include:

This stability makes the plumbing sector a low-risk, high-reward investment.

The plumbing industry is highly fragmented, with many small, independently owned businesses. Private equity firms see:

Many plumbing businesses operate on recurring service models through maintenance contracts and regular service agreements. These recurring revenue streams:

This financial consistency is highly attractive to private equity investors seeking dependable returns.

With increasing environmental awareness, plumbing companies offering sustainable solutions are in high demand. This includes:

The adoption of technology is transforming the plumbing industry. From scheduling and billing software to advanced diagnostic tools, technology enhances:

Investors value businesses that leverage technology to differentiate themselves and achieve competitive advantages.

If you’re looking to attract private equity investment for your Plumbing Business, it’s essential to position your company as a scalable, profitable, and innovative operation. Here are five critical factors to focus on:

Private equity buyers prioritize businesses with predictable, recurring income. To enhance your appeal:

Scalability is a key consideration for private equity investors. Make your business scalable by:

A strong reputation and loyal customer base are critical value drivers. To attract private equity:

Private equity buyers expect clear, well-organized financial data to assess your business’s profitability and growth potential. Ensure your financials reflect:

Environmental and technological advancements are transforming the plumbing industry. To stand out:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.