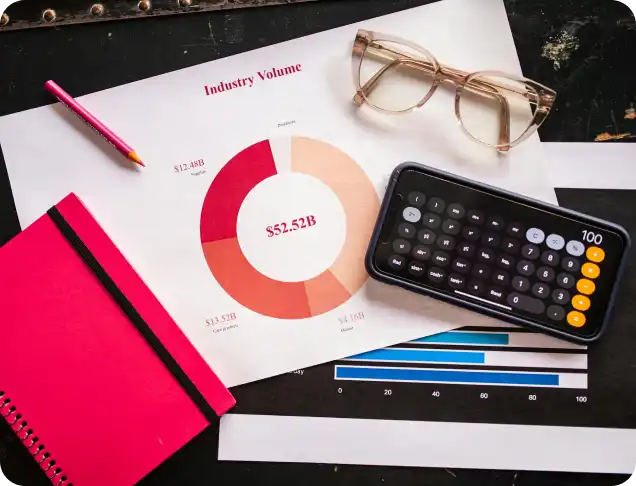

The allergy industry is experiencing rapid growth as the prevalence of allergies continues to rise worldwide. With increasing demand for innovative treatments, diagnostics, and personalized care, the sector offers compelling opportunities for growth and investment. The Advisory Investment Bank stands out as the premier partner for businesses in the allergy industry, offering unparalleled expertise and a proven track record of success.

Check out our latest in depth report on your industry

We understand the unique dynamics of the allergy market, including:

Our specialized knowledge allows us to provide tailored strategies to maximize the value of your business.

Our extensive experience in the healthcare industry enables us to navigate the complexities of the allergy sector. We have successfully advised:

The Advisory Investment Bank maintains relationships with private equity firms, healthcare investors, and strategic acquirers actively seeking opportunities in the allergy industry. We connect our clients with:

Our strategies are designed to highlight the strengths of your practice and maximize its value through:

At The Advisory Investment Bank, we prioritize long-term partnerships and measurable outcomes. Our services include:

The Cosmetic Dentistry Industry has become a prime focus for private equity investors, driven by strong demand and growth potential. Here are the top five reasons why private equity finds this sector so compelling:

As societal focus on appearance and self-confidence grows, more people are investing in their smiles. Key drivers include:

This rising demand ensures a steady stream of patients and predictable revenue.

Cosmetic dentistry offers lucrative, high-margin treatments that are often paid out-of-pocket by patients. These services include:

The cosmetic dentistry sector is characterized by many small, independent practices. Private equity investors are attracted to:

The integration of cutting-edge technologies enhances patient outcomes and operational efficiency, making the industry more attractive to investors. These advancements include:

Practices embracing these innovations can differentiate themselves and command premium valuations.

Cosmetic dentistry is less susceptible to economic downturns compared to other elective procedures. Key factors include:

Attracting private equity investment in the Cosmetic Dentistry Industry requires strategic positioning and a clear demonstration of value. Here are five critical aspects to focus on:

Private equity buyers are drawn to businesses with strong financial performance. To stand out:

A strong patient base and excellent reputation are vital for attracting investors. Focus on:

Private equity buyers value practices that embrace innovation to improve efficiency and outcomes. To enhance appeal:

Private equity investors seek businesses with the potential for expansion. Make your practice more attractive by:

Efficient operations and sound financial management are crucial for long-term success. To meet investor expectations:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.