At The Advisory Investment Bank, we understand the unique challenges and opportunities within the fertility industry. Our expertise and deep industry knowledge make us the ideal partner for businesses in the fertility sector seeking growth, expansion, and strategic investment. Here’s why we are the leading middle-market investment bank for fertility companies:

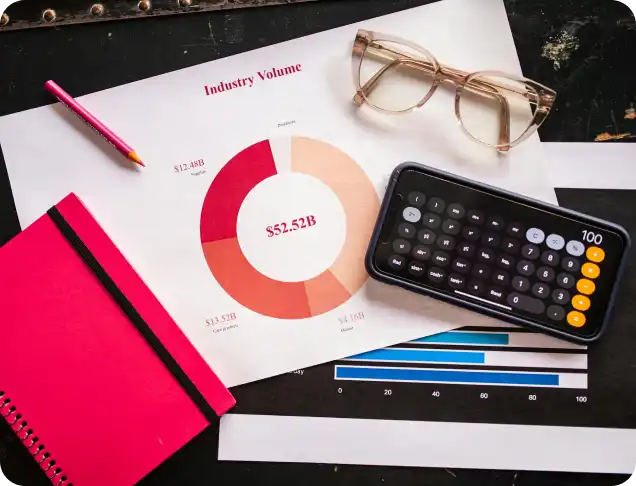

Check out our latest in depth report on your industry

The fertility market has seen significant growth due to rising demand for treatments and services driven by changing social norms, later pregnancies, and increasing infertility rates. With our deep understanding of market dynamics, including the latest advancements in reproductive technologies, we guide our clients to capitalize on these growth opportunities and position their businesses for long-term success.

With decades of experience working with fertility clinics, IVF centers, and reproductive health providers, The Advisory Investment Bank has developed strong relationships with key industry players, including investors, operators, and strategic buyers. This network allows us to identify and access the right partners and opportunities to facilitate your growth and maximize your market value.

Whether your goal is to acquire complementary services, divest underperforming assets, or secure private equity investment, The Advisory Investment Bank has the expertise to handle all aspects of mergers and acquisitions (M&A) in the fertility industry. We have successfully advised on numerous deals, including the sale of fertility clinics, strategic partnerships, and cross-border transactions, ensuring that our clients secure the best possible terms.

We understand the financial complexities of fertility businesses, including revenue cycles driven by high-ticket treatments, insurance considerations, and regulatory constraints. Our team works with you to develop tailored financial strategies that optimize operations, improve profitability, and ensure sustainable growth. From navigating reimbursement policies to understanding the intricacies of the fertility value chain, we provide expert insights every step of the way.

The fertility industry is constantly evolving with the introduction of new technologies, treatments, and patient care options. We help our clients stay ahead of emerging trends, such as genetic screening, egg freezing, and fertility preservation, by identifying investment opportunities that leverage cutting-edge advancements. By staying on top of innovation, we enable fertility companies to gain a competitive edge in a rapidly changing market.

Private equity firms are increasingly recognizing the potential of the fertility industry, which is experiencing rapid growth and offering promising opportunities for investment. Here are five key reasons why private equity finds the fertility sector attractive:

The fertility industry is benefiting from significant shifts in demographics and social behaviors. With more individuals and couples delaying childbearing due to career goals, lifestyle choices, and financial considerations, the demand for fertility treatments, including in-vitro fertilization (IVF) and egg freezing, is on the rise. Private equity sees the industry’s resilience in catering to these growing demands, with consistent revenue generation from both individual patients and healthcare providers.

Innovative advancements in reproductive technologies are transforming the fertility landscape. Private equity investors are drawn to businesses that adopt and integrate cutting-edge treatments such as genetic screening, personalized fertility plans, and enhanced IVF solutions. These innovations provide fertility companies with the potential for higher success rates, patient satisfaction, and ultimately, increased revenue streams.

Fertility treatments are typically high-margin services with the potential for recurring income streams. Many treatments, such as IVF, require multiple cycles, follow-up procedures, and ongoing patient care, resulting in long-term patient relationships. This consistent flow of revenue makes fertility businesses particularly attractive to private equity firms, who are looking for investment opportunities that generate reliable, long-term profits.

The fertility industry remains fragmented, with many smaller fertility clinics and service providers across the market. Private equity firms see this as an opportunity for consolidation through strategic acquisitions. By consolidating fragmented players, private equity can achieve economies of scale, optimize operations, and expand service offerings, all of which contribute to increased profitability and market share.

As public awareness around fertility issues and reproductive health grows, there is a broader acceptance of fertility treatments, particularly in areas like egg freezing, fertility preservation, and gender-neutral reproductive options. This societal shift is driving a steady increase in patient volume, making the fertility sector even more attractive to private equity firms looking for high-growth, high-return investment opportunities.

Private equity firms are always on the lookout for businesses with strong growth potential and solid operational foundations. If you’re in the fertility industry and looking to attract private equity investment, here are five key things you need to keep in mind to increase your appeal:

Private equity buyers value businesses that offer steady, predictable, and recurring revenue. In the fertility industry, treatments like in-vitro fertilization (IVF), egg freezing, and genetic screening can generate multiple revenue cycles from a single patient over time. Highlighting your ability to attract long-term patient relationships and repeat business can make your company more attractive to investors looking for stable cash flow.

Private equity investors are keen on companies that have streamlined operations and cost-effective practices. For fertility businesses, this means efficient clinic management, well-organized patient care processes, and optimized use of medical technologies. Investors will look for opportunities to reduce overhead costs, improve patient throughput, and enhance service delivery, all of which can contribute to higher margins and profitability.

Private equity buyers are typically looking for businesses with substantial room for growth. Whether through geographic expansion, new service offerings, or tapping into underserved markets, demonstrating clear growth opportunities will make your fertility business more attractive. Whether you have plans to open new clinics, expand treatment options, or leverage digital solutions for patient management, showing scalability can pique investors’ interest.

Patient outcomes are critical in the fertility industry. Private equity buyers want to invest in businesses with high success rates and strong patient satisfaction, as these factors contribute to repeat business, referrals, and brand reputation. Demonstrating your clinic’s positive track record, patient testimonials, and quality metrics will give investors confidence that your business is well-positioned to maintain and increase demand.

Private equity firms seek out businesses with experienced, capable leadership that can drive growth post-investment. A strong management team with expertise in reproductive health, operations, and business development is a key factor in attracting private equity. If you don’t already have a robust management team in place, now is the time to recruit or develop leadership talent that can execute the vision of scaling and improving your fertility business.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.