At The Advisory Investment Bank, we specialize in providing expert investment banking services to businesses in the masonry industry, an essential sector that continues to benefit from strong market demand and stable growth. Our experience, in-depth industry knowledge, and commitment to client success have made us the go-to partner for masonry companies looking to grow, attract investment, or successfully navigate mergers and acquisitions. Here’s why we are the leading middle-market investment bank for the masonry sector:

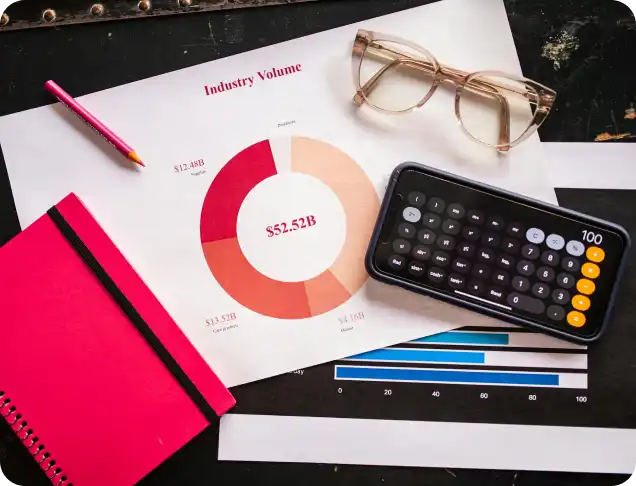

Check out our latest in depth report on your industry

With years of experience working within the masonry industry, The Advisory Investment Bank has developed a deep understanding of the market’s dynamics. From the impact of construction cycles to the evolving demand for sustainable and energy-efficient building materials, we offer invaluable insights that help our clients capitalize on opportunities and navigate challenges. Our team’s familiarity with the masonry market’s unique aspects positions us to provide tailored, strategic advice that drives success.

We have cultivated strong relationships with a diverse network of potential investors, including private equity firms, strategic buyers, and high-net-worth individuals who are actively seeking opportunities in the construction and building materials sectors. This network enables us to connect masonry businesses with the right capital sources and potential acquirers, ensuring a smooth and successful transaction process. Whether your goal is to attract investment or seek an acquisition partner, we leverage our industry relationships to facilitate meaningful connections.

Our team has successfully managed numerous mergers, acquisitions, and capital raises for masonry businesses. We understand the complexities involved in such transactions and are skilled in positioning businesses for sale, managing the due diligence process, and negotiating favorable terms. Whether you’re a buyer or a seller, The Advisory Investment Bank has a proven track record of successfully executing deals in the masonry sector, ensuring that our clients achieve the best possible outcomes.

We work closely with masonry businesses to develop and implement strategies that drive long-term growth. From optimizing operational efficiencies to expanding market share through geographic diversification, we help businesses position themselves for success. Our team provides actionable advice on cost optimization, business scalability, and ways to increase competitive advantage. With our guidance, masonry companies can build a solid foundation for sustained growth and profitability.

At The Advisory Investment Bank, we are experts in business valuation and market positioning, crucial elements when it comes to raising capital or preparing for a sale. We understand how to accurately assess the value of masonry businesses based on various financial and market factors. This expertise ensures that your business is positioned in the best possible light for potential investors or buyers, maximizing its value in the eyes of stakeholders.

The masonry industry offers a range of opportunities that align with the investment goals of private equity firms, including stable cash flows, market resilience, and growth potential. As private equity firms look for investments that deliver strong returns and long-term value, the masonry sector has become increasingly appealing. Here are five key reasons why private equity finds the masonry industry attractive:

Masonry services are integral to construction projects, from residential buildings to large-scale infrastructure developments. With the ongoing need for durable and sustainable building materials, private equity firms recognize the steady demand for masonry services. Whether for new construction or renovations, masonry companies benefit from a reliable customer base, ensuring stable cash flows and a consistent market demand.

The masonry industry tends to show resilience during economic fluctuations, especially when compared to other construction-related sectors. While the broader construction market may experience periods of slowdown, the need for masonry services remains steady, driven by the long-term demand for housing and infrastructure. Private equity investors are attracted to the relative stability this provides, reducing their risk exposure.

Private equity firms often look for businesses where they can add value by improving operations and driving efficiency. In the masonry industry, there are numerous opportunities for streamlining operations, from optimizing labor management and procurement to improving project timelines. By implementing best practices and introducing technology, private equity can help masonry companies increase margins, which enhances the attractiveness of the business as an investment.

Masonry businesses have the potential to scale by expanding into new geographic regions, particularly as demand for construction continues to grow in emerging markets or underserved areas. Private equity investors see the opportunity to fund regional expansion, whether through opening new locations, targeting commercial or industrial sectors, or increasing market share. Geographic diversification also reduces reliance on any single market, mitigating risk and promoting long-term growth.

The masonry industry is often fragmented, with many small to mid-sized businesses competing in local markets. This fragmentation creates opportunities for consolidation through mergers and acquisitions (M&A). Private equity firms recognize the potential to acquire, merge, or integrate smaller masonry firms to build larger, more profitable businesses. By creating economies of scale and improving operational efficiencies, private equity investors can significantly increase the value of these businesses.

If you’re considering attracting a Private Equity (PE) buyer for your masonry business, it’s essential to position your company in the best possible way. PE firms are looking for businesses that offer long-term growth potential, operational efficiency, and strong financial performance. Here are five key things you should focus on to make your masonry business more attractive to a PE buyer:

Private equity firms value businesses with steady cash flows and predictable revenue. In the masonry industry, this can be achieved through long-term contracts, repeat customers, and a well-established presence in stable markets. To make your business more appealing, ensure that you have strong relationships with key clients and demonstrate your ability to generate consistent revenue over time. This reduces the perceived risk for potential buyers and makes your business a more attractive investment.

Operational efficiency is a major area of focus for private equity buyers, as it directly impacts profitability. Review your processes, from project management to procurement, and identify areas where you can reduce waste and increase margins. For example, improving inventory management or optimizing labor deployment can lead to significant cost savings. A well-run business with higher profitability is more attractive to a PE firm, as they see opportunities to scale and improve further.

PE firms are looking for businesses that are scalable, with the potential for growth through geographic expansion or diversification. Consider building a business model that can be easily replicated in new markets or segments. For example, you might want to expand your services to new geographic regions, or increase your focus on both residential and commercial projects. Having a clear roadmap for scaling your business will demonstrate to private equity firms that your company is primed for growth and ready to take on new opportunities.

A strong, experienced management team is critical to the success of your business and its attractiveness to a PE buyer. Private equity firms often prefer to invest in businesses with leadership teams that can drive growth and execute on strategic goals. Ensure that your management team has the right mix of skills and experience to lead the company forward. A clear organizational structure, effective communication channels, and a strong succession plan all add value to your business and give PE firms confidence in the company’s future.

PE firms place a high premium on financial transparency and a strong balance sheet. Ensure that your financials are well-documented, accurate, and up-to-date. This includes maintaining solid financial controls, having a history of profitability, and a manageable debt structure. By providing clear financial reporting and ensuring that your company’s performance is easily understood, you give potential buyers confidence in your business. A healthy balance sheet with positive financial metrics makes your business more attractive for acquisition and minimizes the due diligence risk for buyers.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.