When it comes to advising on middle-market transactions in the accounting industry, The Advisory Investment Bank stands out as a leader. Our deep understanding of the accounting sector, combined with our expertise in middle-market M&A, makes us the go-to investment bank for accounting firms looking to grow, diversify, or transition ownership. Here’s why The Advisory Investment Bank is the leading choice for accounting industry clients:

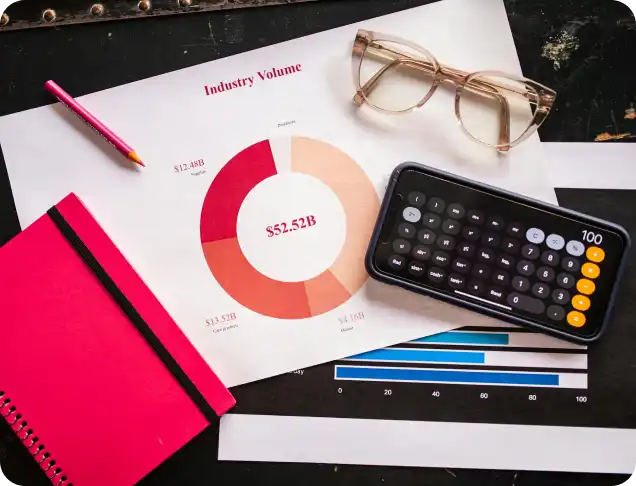

Check out our latest in depth report on your industry

The Advisory Investment Bank has a team of seasoned professionals with extensive experience and knowledge of the accounting sector. We understand the unique challenges and opportunities accounting firms face, whether they specialize in audit, tax services, forensic accounting, or advisory services. Our team leverages this expertise to provide tailored guidance that ensures the highest level of value during every stage of the transaction process.

With years of experience in advising accounting firms on mergers, acquisitions, and succession planning, The Advisory Investment Bank has developed a strong track record of successful transactions in the accounting sector. Our deep relationships with industry participants and our robust understanding of deal structures and valuation drivers make us the ideal partner to help you achieve optimal outcomes in a sale or acquisition.

We don’t just facilitate one-time deals; we focus on driving sustained growth and value creation for accounting firms. Whether you’re looking to expand through acquisition, increase market share, or enhance your service offerings, The Advisory Investment Bank provides strategic advice to help you capitalize on new growth opportunities. Our expertise in driving business expansion strategies ensures that your firm will be positioned for long-term success.

Achieving the best possible price for your firm requires sophisticated valuation and expert negotiation skills. At The Advisory Investment Bank, we employ comprehensive financial models to accurately assess the value of your accounting firm and guide you through the negotiation process. Our advisors have the experience needed to navigate complex deal dynamics and structure transactions that align with your business goals, maximizing the financial benefits for your firm.

The Advisory Investment Bank takes a personalized approach to each engagement. We recognize that every accounting firm is unique, with its own culture, service offerings, and financial profile. Whether you’re considering a full exit, a merger, or bringing in a strategic partner, we work with you to design a transaction structure that aligns with your specific goals. This bespoke approach ensures that your interests are at the forefront of every decision.

When it comes to advising on middle-market transactions in the accounting industry, The Advisory Investment Bank stands out as a leader. Our deep understanding of the accounting sector, combined with our expertise in middle-market M&A, makes us the go-to investment bank for accounting firms looking to grow, diversify, or transition ownership. Here’s why The Advisory Investment Bank is the leading choice for accounting industry clients:

The Advisory Investment Bank has a team of seasoned professionals with extensive experience and knowledge of the accounting sector. We understand the unique challenges and opportunities accounting firms face, whether they specialize in audit, tax services, forensic accounting, or advisory services. Our team leverages this expertise to provide tailored guidance that ensures the highest level of value during every stage of the transaction process.

With years of experience in advising accounting firms on mergers, acquisitions, and succession planning, The Advisory Investment Bank has developed a strong track record of successful transactions in the accounting sector. Our deep relationships with industry participants and our robust understanding of deal structures and valuation drivers make us the ideal partner to help you achieve optimal outcomes in a sale or acquisition.

We don’t just facilitate one-time deals; we focus on driving sustained growth and value creation for accounting firms. Whether you’re looking to expand through acquisition, increase market share, or enhance your service offerings, The Advisory Investment Bank provides strategic advice to help you capitalize on new growth opportunities. Our expertise in driving business expansion strategies ensures that your firm will be positioned for long-term success.

Achieving the best possible price for your firm requires sophisticated valuation and expert negotiation skills. At The Advisory Investment Bank, we employ comprehensive financial models to accurately assess the value of your accounting firm and guide you through the negotiation process. Our advisors have the experience needed to navigate complex deal dynamics and structure transactions that align with your business goals, maximizing the financial benefits for your firm.

The Advisory Investment Bank takes a personalized approach to each engagement. We recognize that every accounting firm is unique, with its own culture, service offerings, and financial profile. Whether you’re considering a full exit, a merger, or bringing in a strategic partner, we work with you to design a transaction structure that aligns with your specific goals. This bespoke approach ensures that your interests are at the forefront of every decision.

When preparing your accounting firm for a potential sale or partnership with a Private Equity buyer, it’s crucial to position your business as an attractive investment. Private Equity firms look for certain characteristics in a company that demonstrate long-term growth potential, stable cash flow, and scalability. Here are five key things to keep in mind to make your accounting firm more appealing to potential buyers:

Private Equity buyers are attracted to businesses with predictable, recurring revenue. In the accounting industry, this typically means having a stable base of long-term clients with retainer-based agreements, ongoing tax preparation services, or audit contracts that generate consistent cash flow. Highlighting your firm’s long-standing relationships with clients, as well as the consistency and sustainability of your revenue, will help reassure potential buyers of the firm’s value and growth prospects.

Private Equity firms are interested in businesses that have scalable operations and the potential to expand their service offerings. Accounting firms that have a diversified range of services — from audit and tax preparation to advisory and consulting — can be more attractive to buyers, as it mitigates risk and enhances growth potential. If your firm specializes in a particular niche, consider expanding your capabilities or service areas to increase your appeal to a broader set of potential buyers.

A well-maintained financial record is crucial to making your firm attractive to a Private Equity buyer. Ensure that your financial statements are clean, accurate, and demonstrate strong performance, particularly in terms of profitability. Private Equity investors often seek businesses with healthy profit margins and a history of strong cash flow. Demonstrating financial discipline and showing a clear path to continued profitability can greatly increase your attractiveness.

Private Equity buyers seek businesses that have efficient, streamlined operations and are easy to integrate into their existing portfolio. This includes having well-defined processes, strong management teams, and effective technology systems in place. Highlight how your firm’s internal operations — from client onboarding to billing and compliance — are well-organized and optimized for scalability. Additionally, having a capable leadership team that can run the business independently adds value by reducing operational risk.

evaluating your firm. This includes having a loyal client base, good industry standing, and a history of high client satisfaction. Demonstrating your firm’s ability to maintain long-term relationships with clients and provide high-quality service will reassure potential buyers of the firm’s sustainability and reputation. If possible, provide testimonials, case studies, or client retention metrics to illustrate the strength of your client relationships.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.