At The Advisory Investment Bank, we specialize in delivering strategic advisory services for the Beauty & Personal Care sector. Our in-depth understanding of the unique dynamics of this fast-evolving industry, combined with our expertise in middle-market transactions, positions us as the ideal partner for businesses in this space. Here’s why we are the leading middle-market investment bank for the Beauty & Personal Care industry:

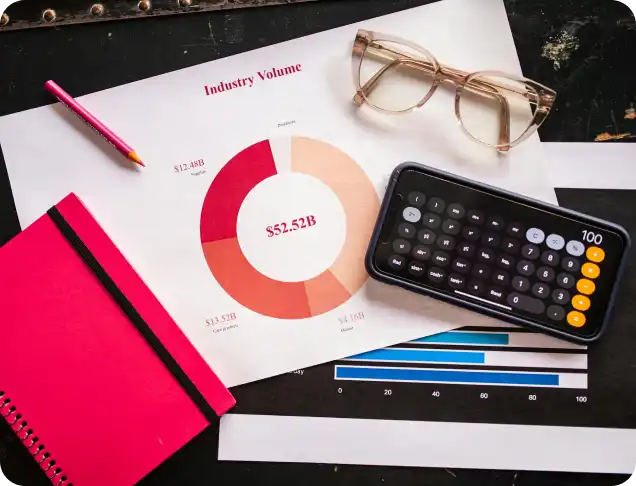

Check out our latest in depth report on your industry

Our team of advisors has a deep understanding of the Beauty & Personal Care industry, which includes skincare, haircare, cosmetics, and wellness products. We know what drives growth, from changing consumer preferences to emerging market trends like clean beauty, sustainability, and technological advancements in personal care products. This expertise allows us to craft tailored strategies that help clients navigate challenges, maximize opportunities, and achieve their business objectives.

We have a proven track record of helping businesses in the Beauty & Personal Care sector achieve successful outcomes. From mergers and acquisitions (M&A) to private equity transactions, we have consistently delivered exceptional results for our clients, ensuring that they receive the highest value for their businesses. Our expertise in middle-market deals enables us to structure transactions that maximize value and minimize risk, positioning our clients for long-term success.

The Advisory Investment Bank has built an extensive network of industry contacts, including private equity firms, strategic buyers, and other key players in the Beauty & Personal Care sector. This network gives us access to a broad pool of potential buyers and investors who are actively seeking high-quality opportunities. Whether you’re looking to sell your business, raise capital, or explore strategic partnerships, our connections enable us to connect you with the right stakeholders and facilitate successful deals.

The Beauty & Personal Care sector is known for its fast-paced nature, with trends changing quickly and consumer preferences evolving rapidly. Our team is adept at staying ahead of these shifts and understanding the emerging trends that shape the industry. Whether it’s the growing demand for eco-friendly products, the rise of e-commerce, or the increasing importance of influencer marketing, we have the insights and knowledge to help businesses align with these trends and create value for their stakeholders.

At The Advisory Investment Bank, we prioritize long-term value creation for our clients in the Beauty & Personal Care industry. We help businesses not only achieve short-term goals but also build sustainable growth strategies that ensure success in the years to come. Our approach is centered on identifying and leveraging your company’s unique strengths, whether it’s a strong brand, a loyal customer base, or innovative product offerings, to maximize its future potential.

Private equity firms are increasingly drawn to the Beauty & Personal Care industry due to its robust growth potential, consumer demand, and evolving market trends. Here are five key reasons why this sector is an attractive investment opportunity for private equity firms:

The Beauty & Personal Care industry has consistently shown resilience, even during economic downturns. Consumers’ desire for self-care, wellness, and personal grooming remains a driving force behind sustained demand for products like skincare, haircare, cosmetics, and wellness solutions. With increasing focus on personal wellness and self-care routines, private equity firms recognize the industry’s ability to deliver stable cash flows and long-term growth.

The industry is undergoing significant transformation, with emerging trends such as clean beauty, sustainability, and digital beauty experiences reshaping the market. These evolving consumer preferences provide ample growth opportunities for businesses that are ahead of the curve. Private equity investors are attracted to companies that are able to capitalize on these trends, as they offer substantial returns while aligning with modern consumer values and demands.

The Beauty & Personal Care industry is highly fragmented, with many mid-sized players and niche brands competing in specialized segments. This fragmentation creates significant consolidation opportunities for private equity firms seeking to scale businesses. By acquiring or merging with complementary companies, private equity firms can create market leaders, increase operational efficiencies, and drive revenue growth through economies of scale.

The rapid rise of e-commerce and direct-to-consumer (DTC) business models has revolutionized the beauty industry, enabling companies to expand their reach and drive revenue growth. Additionally, the growing demand for beauty products in emerging global markets, particularly in Asia, provides new avenues for growth. Private equity investors are attracted to businesses that have a solid online presence and international growth potential, as these channels offer high scalability and access to a broader customer base.

The Beauty & Personal Care sector has historically enjoyed strong valuation multiples due to its attractive growth prospects, recurring consumer demand, and brand loyalty. Private equity firms are drawn to the potential for high returns on investment (ROI) when businesses are positioned for strategic exits through mergers, acquisitions, or IPOs. With the increasing interest in beauty brands and wellness companies from both strategic buyers and public markets, private equity firms see a clear path to profitable exits.

If you’re looking to attract private equity investment in the Beauty & Personal Care industry, it’s crucial to focus on key aspects of your business that will resonate with potential buyers. Here are five things you should keep in mind to make your business more appealing:

Private equity buyers are drawn to companies with a strong, recognizable brand that resonates with consumers. A well-defined brand identity that aligns with current market trends, such as sustainability, clean beauty, or inclusivity, adds significant value. Your brand should be easily scalable, allowing for expansion into new markets, products, or demographics. Developing a clear, compelling brand story is critical to attracting investor interest.

In today’s market, a robust digital presence is a must. Private equity investors are particularly interested in businesses with an established e-commerce strategy and strong social media following. If your business already has a successful direct-to-consumer (DTC) model or is generating significant revenue through digital channels, this will position your company as a highly attractive investment. An effective e-commerce platform that drives customer acquisition, retention, and repeat business is essential.

The Beauty & Personal Care industry is driven by rapidly changing consumer trends. Private equity buyers look for companies that can innovate and stay ahead of trends, such as clean beauty, sustainability, and wellness. Your ability to introduce new, unique products that align with evolving consumer preferences and address unmet needs is highly attractive. Consider emphasizing product development cycles, intellectual property, and R&D capabilities to demonstrate your company’s innovation potential.

Investors are looking for companies with strong financials and a clear growth trajectory. Ensure your business has consistent revenue growth, healthy profit margins, and clear plans for future expansion. Private equity buyers are also interested in businesses with strong cash flow and low operational risks. Transparent financial records, good management practices, and solid financial projections will build investor confidence and show that your business is a reliable investment opportunity.

Private equity investors seek businesses that can be scaled efficiently. This includes having streamlined operations, a solid supply chain, and effective inventory management. Investors are also interested in how well your business adapts to increased demand without compromising quality or customer experience. By focusing on operational efficiencies, cost control, and scalability, you’ll demonstrate that your business is ready for growth and capable of handling expansion into new markets, both domestically and internationally.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.