At The Advisory Investment Bank, we are committed to helping businesses in the Health & Wellness industry unlock their full potential and achieve sustainable growth. Our extensive experience, deep industry expertise, and proven track record make us the ideal partner for companies looking to navigate the complexities of the middle market. Here’s why we are the leading choice for Health & Wellness investments:

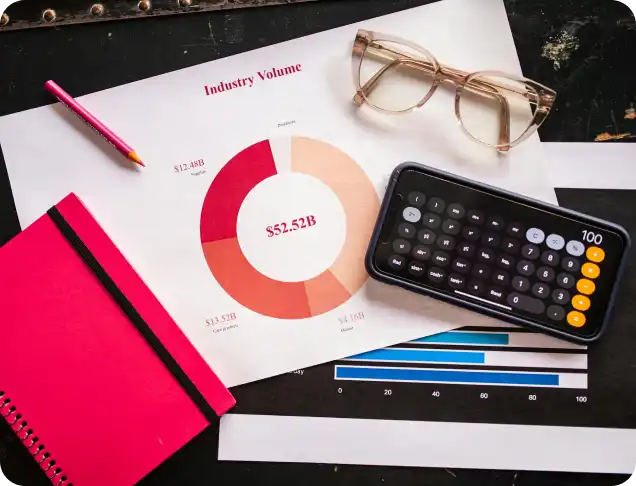

Check out our latest in depth report on your industry

The Health & Wellness sector is diverse, spanning everything from fitness and nutrition to mental well-being and holistic health. Our team of experts has a deep understanding of the key drivers and trends within the industry, including consumer behavior shifts, regulatory considerations, and emerging technologies. We leverage this expertise to identify lucrative investment opportunities and provide tailored solutions that meet the unique challenges of businesses in this space.

Our track record speaks for itself. Over the years, we have facilitated numerous high-value transactions within the Health & Wellness industry, helping our clients achieve optimal deal outcomes. Whether it’s mergers, acquisitions, or capital raises, we have consistently delivered results. Our experience with middle-market deals in this industry gives us the insights needed to navigate complex negotiations and secure the best possible outcomes for our clients.

As a leading advisory firm, we have cultivated extensive relationships with top-tier private equity firms, venture capitalists, and institutional investors that specialize in the Health & Wellness sector. This network enables us to provide our clients with access to targeted capital and strategic partnerships that are key to unlocking growth. Whether your company is looking to expand, scale operations, or enter new markets, our connections ensure you have the resources to achieve your goals.

We continuously monitor Health & Wellness trends to help our clients stay ahead of the curve. From digital health technologies and personalized wellness services to sustainable practices and holistic healthcare, we understand the key factors shaping the industry. We guide our clients in aligning their business strategies with the latest trends to maximize value, drive profitability, and ensure long-term success in an evolving market.

At The Advisory Investment Bank, we know that each Health & Wellness business is unique. We take the time to understand your company’s specific needs, goals, and market position. By offering customized investment strategies, we help you optimize your value proposition, attract the right buyers, or secure the most favorable financing terms. Our client-centric approach ensures that your investment strategy is designed to maximize your business’s potential.

The Health & Wellness industry is experiencing rapid growth and transformation, making it an increasingly attractive sector for private equity investors. With a focus on both profitability and long-term sustainability, private equity firms are drawn to this dynamic market. Here are five key reasons why private equity finds the Health & Wellness industry so appealing:

The Health & Wellness sector benefits from consistent consumer demand, driven by growing awareness of the importance of physical, mental, and emotional well-being. People are investing more in fitness, nutrition, mental health support, and preventative healthcare, making this industry highly resilient to economic downturns. Private equity investors are attracted to industries with strong, lasting demand, and Health & Wellness ticks all the boxes.

The industry encompasses a wide variety of sub-sectors, from fitness and gym memberships to mental health services and nutritional supplements. Private equity firms see significant opportunities for niche market growth and consolidation. Companies with specialized products or services in emerging areas, such as digital health, holistic care, and personalized wellness, can experience rapid expansion, making them attractive targets for investment.

Many businesses within the Health & Wellness industry, such as subscription-based fitness apps, wellness retreats, and nutrition services, operate on a recurring revenue model. This creates a predictable cash flow, which is highly attractive to private equity investors. The stability and scalability of these recurring revenue models provide a strong foundation for long-term profitability and growth.

Technology is transforming the Health & Wellness space, with innovations in digital health platforms, telemedicine, wearable devices, and personalized medicine. Private equity firms are eager to capitalize on these advancements, which create new market opportunities and the potential for disruptive growth. Investments in technology-driven health solutions offer a high return potential, especially when businesses are positioned to leverage cutting-edge developments.

There is a growing shift towards preventative care and longevity as consumers prioritize staying healthy and maintaining a high quality of life for longer. This trend is reshaping healthcare, wellness services, and fitness industries. As more people embrace proactive health management, the demand for wellness products and preventative treatments continues to rise. Private equity investors are drawn to businesses that cater to these expanding consumer needs, as they present significant growth potential in the long term.

To successfully attract private equity investment in the Health & Wellness industry, your business needs to demonstrate its ability to scale, innovate, and create sustained value. Private equity investors are focused on long-term growth and profitability, so understanding what they look for in an investment is crucial. Here are five key considerations to ensure your business stands out to private equity buyers:

Private equity buyers are highly interested in companies that can generate consistent, recurring revenue streams. For businesses in the Health & Wellness sector, this means offering services or products that attract repeat customers—such as subscription-based wellness services, membership programs, or ongoing health consultations. If your business operates on a recurring revenue model, it will appear more stable and predictable, which is a key factor for private equity investors looking for lower-risk opportunities.

Private equity investors seek businesses that have the potential to scale rapidly. Whether you offer health coaching, fitness classes, or nutritional supplements, it’s crucial to demonstrate a proven business model that can be replicated in different markets or geographies. Show that your processes, systems, and infrastructure are built for growth. The more scalable your operations, the more attractive your business becomes to private equity firms looking to expand quickly.

Investors are particularly drawn to businesses that stand out from the competition. To make your Health & Wellness business attractive to private equity buyers, it’s essential to highlight what differentiates you from the rest. This could include proprietary technology, unique service offerings, a strong brand identity, or a specialized niche. For example, if your business uses cutting-edge technology (like AI-driven health assessments or wearable fitness trackers), this innovation can significantly increase your appeal to private equity investors looking for the next big opportunity.

Private equity investors want to see a loyal customer base with a high lifetime value. Demonstrate that your business has a strong reputation and customer retention rates, whether through positive testimonials, customer reviews, or repeat business. Focus on building relationships with customers and enhancing their experience to ensure loyalty. Expanding your customer base and showing that your business is not overly reliant on any single group or market will make your company more attractive to private equity buyers.

Private equity investors are looking for businesses with a clear vision for sustainable growth. Develop and share a comprehensive growth strategy that includes plans for expanding your offerings, reaching new markets, increasing operational efficiencies, or introducing new revenue streams. Private equity buyers are particularly interested in companies that not only have a plan for short-term profitability but also demonstrate a long-term vision for success. Focus on cost control, product innovation, and market expansion to show your growth trajectory.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.