At The Advisory Investment Bank, we pride ourselves on being a trusted partner for dermatology businesses in the middle market. We understand the unique dynamics and opportunities within the dermatology sector, and we have the expertise to guide your business through successful transactions. Here’s why we are the leading investment bank for the dermatology industry:

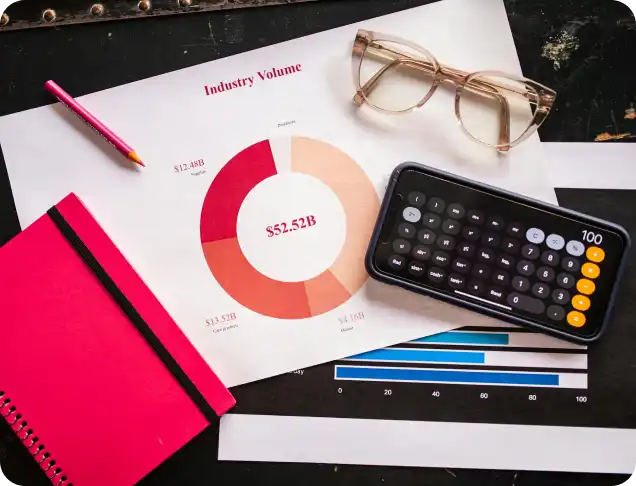

Check out our latest in depth report on your industry

With extensive experience in the healthcare and dermatology sectors, we have a nuanced understanding of the challenges and opportunities that dermatology businesses face. From private practices to multi-location dermatology groups, we understand the specific operational, financial, and regulatory dynamics at play. Our team’s deep knowledge of the market enables us to provide tailored strategies that address the needs of dermatology practices and help drive long-term success.

We have cultivated strong relationships with a diverse network of potential investors, including private equity firms, strategic buyers, and high-net-worth individuals who are actively seeking opportunities in the construction and building materials sectors. This network enables us to connect masonry businesses with the right capital sources and potential acquirers, ensuring a smooth and successful transaction process. Whether your goal is to attract investment or seek an acquisition partner, we leverage our industry relationships to facilitate meaningful connections.

The dermatology industry has unique value drivers, such as patient retention, quality of care, innovative treatments, and regulatory compliance. At The Advisory Investment Bank, we understand how these factors influence the valuation of dermatology practices. By focusing on key performance indicators (KPIs) such as patient volume, revenue per visit, and operational efficiency, we help maximize the value of your dermatology business for potential buyers or investors.

Our extensive network of private equity firms, strategic buyers, and institutional investors ensures that we can connect dermatology businesses with the right capital partners. Whether you are seeking a growth investment or preparing for an exit, our network provides access to a broad pool of qualified buyers and investors who are actively looking for opportunities in the dermatology space.

From initial consultation to final execution, The Advisory Investment Bank provides comprehensive M&A advisory services. We offer in-depth strategic planning, valuation analysis, buyer identification, due diligence support, and transaction negotiation. Our full-service approach ensures that you receive expert guidance throughout the entire process, helping you achieve the best possible outcome in the sale or growth of your dermatology practice.

The dermatology industry presents a compelling opportunity for Private Equity (PE) firms seeking to invest in a growing and resilient sector. Here are five key reasons why private equity finds the dermatology industry particularly attractive:

The demand for dermatology services is consistently growing, driven by several factors, including an aging population, increasing awareness of skin health, and a rising incidence of skin conditions like acne, eczema, and skin cancer. Additionally, non-surgical cosmetic dermatology treatments, such as Botox and laser procedures, continue to grow in popularity. This steady demand provides a strong foundation for growth and revenue generation, making dermatology practices attractive investments for PE firms looking for long-term, stable returns.

The dermatology industry is highly fragmented, with many small independent practices and regional players. This fragmentation creates significant opportunities for consolidation and expansion, a strategy that PE firms often pursue to drive value. By acquiring multiple practices or growing through strategic roll-ups, PE investors can realize economies of scale, expand their market share, and improve operational efficiencies, all of which contribute to enhanced profitability.

Dermatology practices, particularly those focusing on medical dermatology and cosmetic procedures, benefit from recurring revenue streams. Patients often require regular treatments, check-ups, and follow-up visits, which provide a predictable and stable cash flow. The ability to generate consistent revenues over time makes dermatology businesses an attractive option for PE investors who seek businesses with dependable and recurring income, minimizing risk and increasing the potential for sustained returns.

Cosmetic dermatology, in particular, offers high-margin services such as Botox injections, laser treatments, and other aesthetic procedures. These treatments typically come with a strong profit margin and minimal overhead costs. Medical dermatology services, such as skin cancer screenings and treatments, also have attractive margins due to the relatively low cost of goods sold. PE firms are drawn to industries where they can invest in high-margin businesses and realize significant profitability through operational improvements or strategic growth.

Private equity firms are always looking for businesses with the potential for expansion, and the dermatology industry offers multiple avenues for growth. Practices can expand geographically, offer additional services, or implement innovative technologies to improve patient care and outcomes. Advancements in dermatological treatments, telemedicine for consultations, and integration of AI and other technology-driven solutions create further opportunities for growth. PE firms value businesses with scalable models and the potential to capitalize on emerging trends in the healthcare industry, making dermatology an attractive investment option.

When preparing your dermatology practice for a potential Private Equity (PE) investment or acquisition, there are several key factors to consider. Private equity firms are highly discerning in their investment decisions, and understanding what makes your business attractive to them is crucial for achieving the best possible outcome. Here are five essential considerations to make your dermatology business appealing to a PE buyer:

Private equity firms are drawn to businesses with stable, recurring revenues. In the dermatology industry, this often means a mix of both medical dermatology (e.g., skin cancer treatment, acne care) and aesthetic procedures (e.g., Botox, laser treatments). To enhance your attractiveness to a PE buyer, ensure that your practice has built a loyal patient base, a predictable stream of repeat visits, and solid financial records. Additionally, diversifying revenue sources, such as adding high-margin cosmetic services, can improve the long-term financial stability of your practice.

PE buyers look for businesses that are operating efficiently and profitably. Streamline your operations to minimize costs while maintaining high-quality patient care. Key areas to focus on include optimizing staff utilization, reducing overhead, and improving appointment scheduling. Additionally, consider implementing technology to enhance operational efficiency, such as electronic medical records (EMR) systems or patient management software. A highly profitable and well-run practice demonstrates strong potential for further growth and value creation under PE ownership.e scalability:

PE firms are often interested in businesses that can scale and expand quickly. If your dermatology practice is primarily a single location, consider developing a roadmap for future growth, whether through expanding your physical presence to new geographic areas, offering additional services, or pursuing strategic acquisitions of smaller practices. Having a clear strategy for scaling your practice will signal to PE firms that your business has significant potential for further value creation.

Patient loyalty and satisfaction are essential to the long-term success of any dermatology practice. High patient retention rates are particularly attractive to PE investors, as they indicate a solid and reliable revenue base. Ensure that your practice delivers outstanding patient care and service. Gathering patient testimonials, conducting patient satisfaction surveys, and maintaining high levels of online reviews can also help demonstrate the strength of your patient relationships. A practice that consistently meets or exceeds patient expectations will have a higher valuation in the eyes of PE investors.

Private equity firms invest in businesses that have a clear competitive edge. In dermatology, this might involve having specialized expertise in a niche area (e.g., dermatologic surgery, advanced cosmetic procedures, or pediatric dermatology), offering cutting-edge technology or treatments, or establishing a strong brand in a particular market. Ensure that your practice has a distinctive position that sets it apart from competitors. This could be a unique service offering, a reputation for excellence, or a proprietary technology or process that drives patient outcomes.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.