At The Advisory Investment Bank, we have established ourselves as the leading middle market investment bank for the HVAC (Heating, Ventilation, and Air Conditioning) industry. Our deep industry knowledge, extensive network, and track record of successful transactions make us uniquely positioned to provide unmatched advisory services to businesses in the HVAC sector. Here’s why we are the preferred choice for HVAC companies looking to navigate the middle market investment landscape:

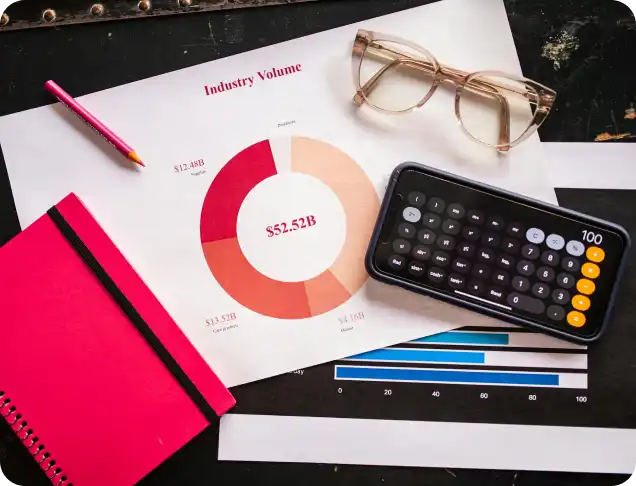

Check out our latest in depth report on your industry

The HVAC industry has its own set of challenges and opportunities. At The Advisory Investment Bank, we specialize in this sector, leveraging our deep understanding of its dynamics to advise clients effectively. From market trends to regulatory changes, we stay ahead of the curve, helping our clients make informed decisions. This expertise allows us to provide tailored solutions that drive growth and maximize value in HVAC transactions.

We have a proven track record of successfully advising HVAC companies on mergers, acquisitions, and capital raising efforts. Whether it’s helping businesses sell to a strategic buyer, facilitating private equity investments, or guiding companies through a recapitalization process, we have the experience and expertise to ensure the best possible outcomes. Our clients trust us because of our consistent success in delivering value and executing HVAC transactions with precision.

We have a proven track record of successfully advising HVAC companies on mergers, acquisitions, and capital raising efforts. Whether it’s helping businesses sell to a strategic buyer, facilitating private equity investments, or guiding companies through a recapitalization process, we have the experience and expertise to ensure the best possible outcomes. Our clients trust us because of our consistent success in delivering value and executing HVAC transactions with precision.

We provide a full suite of M&A and capital advisory services for HVAC companies, from financial analysis and business valuation to strategic planning and deal negotiation. Our comprehensive approach ensures that every aspect of the transaction is handled with care, enabling HVAC business owners to make decisions that align with their long-term goals. Our team works closely with you to develop strategies that unlock the full value of your business and guide you through every stage of the deal process.

At The Advisory Investment Bank, we focus not just on completing a transaction but on creating value for the long-term success of your HVAC business. Our goal is to help your company achieve sustainable growth, improve operational efficiency, and unlock its full potential. Whether you’re looking to expand through acquisition, secure new funding for growth, or exit the business, we work alongside you to ensure that your HVAC company is positioned for success both before and after the transaction.

The HVAC (Heating, Ventilation, and Air Conditioning) industry has long been a favorite among private equity firms. With its resilient market demand, essential service offerings, and significant growth potential, the HVAC sector offers compelling investment opportunities. Here are 5 key reasons why private equity firms find the HVAC industry particularly attractive:

The HVAC industry benefits from year-round, consistent demand driven by both residential and commercial sectors. As heating and cooling systems are essential for homes, businesses, and industrial facilities, HVAC services are considered recession-resistant. With the growing need for energy-efficient systems and environmental concerns, demand for HVAC services and technologies is expected to rise, making it an attractive long-term investment for private equity.

The HVAC industry is highly fragmented, with many small to mid-sized players operating locally or regionally. This fragmentation presents substantial opportunities for consolidation. Private equity firms can pursue roll-up strategies to acquire smaller companies, improve operational efficiencies, and gain market share. Consolidating businesses within this sector allows private equity firms to realize economies of scale and position their portfolio companies for greater profitability.

Many HVAC companies have recurring revenue models, particularly those offering maintenance contracts and service agreements. This model generates predictable cash flow, which is highly attractive to private equity firms looking for stable, recurring returns. Service agreements help companies maintain long-term customer relationships, creating opportunities for sustained growth and profitability over time.

The HVAC industry is undergoing significant technological advancements, including the integration of smart technologies, energy-efficient solutions, and environmentally friendly systems. As regulations around energy consumption become stricter, the demand for more efficient and sustainable HVAC systems will continue to grow. Private equity firms find this trend appealing as it opens up opportunities for portfolio companies to innovate, capture market share, and drive higher margins through cutting-edge solutions.

The HVAC sector is known for its strong cash flow generation and high margins, particularly in the service and repair side of the business. HVAC businesses that maintain strong customer bases, high service contract renewals, and efficient operations can generate substantial profits. These characteristics make HVAC companies highly attractive to private equity, who seek stable cash flows and profitable businesses that can deliver significant returns on investment.

Attracting private equity investment for your HVAC (Heating, Ventilation, and Air Conditioning) business requires strategic planning and an understanding of the factors that make a company appealing to investors. If you are looking to position your business for a successful acquisition or investment, here are 5 things to keep in mind:

Private equity firms are attracted to businesses that generate stable, predictable cash flow. In the HVAC industry, service contracts, maintenance agreements, and subscription-based services offer recurring revenue, which is highly appealing to investors. By focusing on securing long-term service contracts and building a strong base of repeat customers, you can make your business more attractive by demonstrating financial stability and future growth potential.

Investors look for companies with efficient operations and a strong focus on profitability. Optimizing your business processes—such as inventory management, scheduling, customer service, and technician performance—can help reduce operational costs and increase margins. Private equity firms will look for HVAC businesses that are able to operate efficiently while maintaining high-quality service, as this leads to greater profitability and scalability.

The HVAC industry is rapidly evolving with the advent of smart technology, energy-efficient solutions, and environmentally friendly products. Private equity buyers are particularly interested in businesses that embrace these advancements. By investing in cutting-edge technologies, like smart thermostats, automated systems, and sustainable HVAC solutions, you can position your business as a forward-thinking leader in the market. This enhances its appeal to investors looking to tap into emerging trends and capitalize on growing consumer demand for energy-efficient products.

Private equity firms value companies with a loyal customer base and high customer retention rates. The HVAC industry thrives on long-term relationships, especially with commercial clients and property management companies. By focusing on exceptional customer service, maintaining quality standards, and implementing customer retention strategies (like loyalty programs or maintenance reminders), you can enhance your business’s value proposition to private equity investors.

Private equity firms are interested in businesses that have clear paths for future growth. This could include expanding into new geographical markets, offering additional services (like air quality solutions, advanced energy management, etc.), or capturing new customer segments (e.g., eco-conscious consumers or businesses seeking green solutions). Highlighting how your HVAC business can scale and increase market share over time will make your company more attractive to investors seeking to maximize returns.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.