The Landscaping industry offers significant growth potential, driven by increasing demand for residential, commercial, and sustainable outdoor solutions. The Advisory Investment Bank is the trusted partner for landscaping businesses looking to navigate the evolving market and achieve their strategic goals. Here’s why we are the leading middle-market investment bank for landscaping companies:

Check out our latest in depth report on your industry

We possess extensive knowledge of the landscaping sector, including:

Our deep understanding of the industry allows us to identify opportunities that enhance business value and ensure success for our clients.

With a robust network of private equity firms, family offices, and strategic buyers, we connect landscaping businesses to the right partners for growth, investment, or strategic exits. Our relationships with investors who specialize in the landscaping and home services sectors enable us to match your business with the most suitable buyer or investor.

Landscaping businesses often benefit from scaling their operations and diversifying service offerings. At The Advisory Investment Bank, we assist businesses in:

We help position landscaping businesses for growth and operational efficiency, making them more attractive to potential buyers and investors.

Our team has successfully guided landscaping companies through complex transactions, including mergers, acquisitions, and divestitures. We have a proven track record of delivering strong outcomes by understanding the unique challenges of the landscaping industry and providing tailored strategies for each client.

From valuations and market assessments to negotiations and deal structuring, we provide end-to-end advisory services to help landscaping businesses achieve optimal results. We guide clients through every step of the transaction process, ensuring that their business is positioned for maximum value in the marketplace.

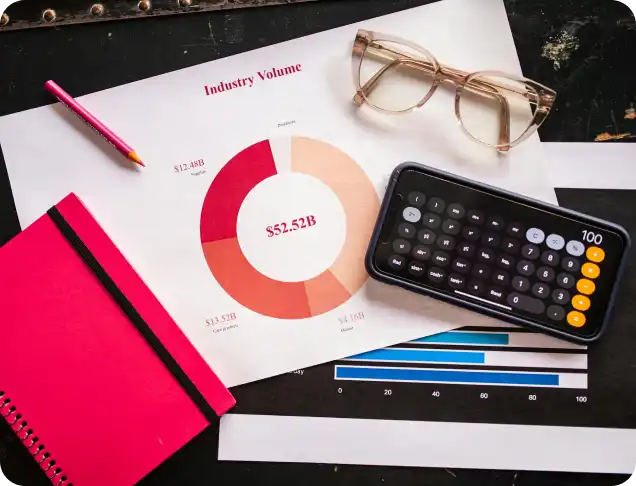

The Landscaping industry presents a compelling investment opportunity for private equity firms, driven by long-term growth trends, stability, and scalability potential. Here are five key reasons why private equity finds this sector particularly appealing:

As the housing market continues to expand and commercial development rises, there is a consistent need for landscaping services. Whether for residential lawns, commercial properties, or public spaces, private equity sees significant growth potential in both sectors. Additionally, the increasing trend toward outdoor living spaces boosts demand for landscaping design and maintenance services.

Landscaping businesses often benefit from a recurring revenue model, with services such as lawn care, maintenance, and seasonal work that provide consistent income year-round. Private equity investors find this recurring cash flow model appealing as it ensures stable financial performance and offers a reliable foundation for growth and profitability.

The landscaping industry is highly fragmented, with many small to mid-sized businesses operating locally or regionally. This fragmentation creates opportunities for consolidation, where private equity firms can acquire and integrate smaller companies to create more efficient, larger-scale operations. By expanding market reach and improving operational efficiencies, consolidation can lead to higher margins and greater value.

As sustainability becomes more important to consumers and businesses alike, there is rising demand for environmentally friendly landscaping services, including water-efficient irrigation systems, native plantings, and organic landscaping solutions. Private equity firms are drawn to companies that can capitalize on this growing trend, offering a competitive advantage and a strong market position in an eco-conscious landscape.

The landscaping industry offers numerous pathways for scalability and diversification, making it attractive to private equity investors. Companies can expand by offering additional services such as tree care, hardscaping, outdoor design, and snow removal. Geographic expansion is also a key strategy, with many businesses looking to enter new regions or increase their market share in underserved areas.

If you’re looking to attract a private equity buyer for your Landscaping business, it’s important to focus on key factors that highlight your company’s value and growth potential. Here are five things to keep in mind when preparing your landscaping business for sale or investment:

Private equity buyers are drawn to businesses with predictable and stable cash flows. To make your landscaping business more attractive, focus on building consistent, recurring revenue streams, such as:

Highlighting these predictable income sources ensures your business offers financial stability, making it a more appealing investment.

Private equity investors are interested in businesses that can expand rapidly with additional investment. To demonstrate scalability, consider:

A clear growth strategy will demonstrate that your business has significant potential for expansion and increased profitability.

Private equity buyers are highly focused on operational efficiency, as it directly impacts margins and profitability. To make your business more attractive:

By improving operational efficiency, you can increase the value of your business and reduce risks for potential buyers.

A recognizable brand and loyal customer base are highly attractive to investors. Ensure your business stands out by:

A strong brand and an established, loyal client base offer a competitive edge and reduce the perceived risk for potential investors.

Private equity buyers rely on clear, accurate financial statements to evaluate a business’s performance and potential. To make your business more attractive:

Providing transparent and well-organized financials will instill confidence in potential buyers and facilitate the due diligence process.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.