At The Advisory Investment Bank, we specialize in guiding businesses in the Marketing Services sector through their most important transitions. Whether you’re preparing for an acquisition, seeking investment, or looking to expand, we offer unparalleled expertise and a proven track record of success in the middle market.

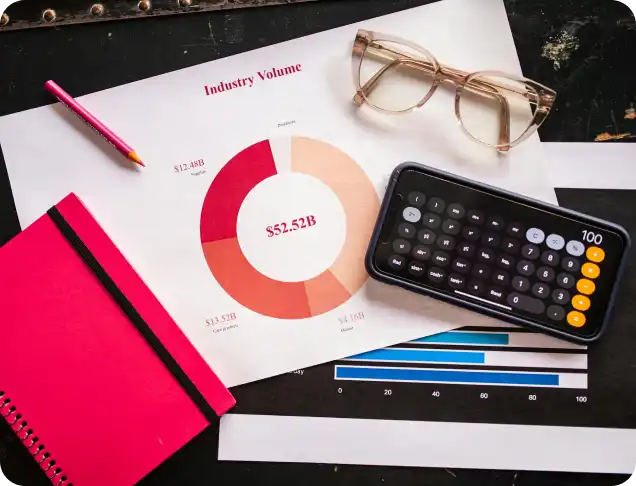

Check out our latest in depth report on your industry

The marketing services industry is evolving rapidly with digital transformation, data-driven strategies, and technological innovations. At The Advisory Investment Bank, we have an in-depth understanding of these shifts and the impact they have on companies in the space. Our team is well-versed in the unique dynamics and challenges of the marketing services industry, which allows us to deliver tailored advice and solutions that meet your specific needs.

With years of experience working with marketing services companies, we have developed a robust track record of helping businesses achieve optimal outcomes. We understand the intricacies of valuations, negotiations, and deal structuring within this sector. Whether you’re selling your business or seeking strategic partnerships, our expertise ensures that we maximize your business’s value and secure the best terms for your deal.

We have established strong relationships with a vast network of private equity firms, strategic buyers, and investors that are actively seeking opportunities in the marketing services sector. Our deep connections within the industry enable us to match your business with the right buyer or investor who shares your vision for growth and value creation.

Marketing services companies thrive on innovation and adapting to changing market demands. We work closely with business owners to identify growth opportunities, improve operational efficiencies, and develop scalable strategies. Whether through mergers, acquisitions, or organic growth initiatives, we have the expertise to help your company navigate the next stage of its journey, ensuring you are well-positioned for success.

At The Advisory Investment Bank, we provide comprehensive support throughout the entire transaction process. From initial business valuation and market analysis to negotiation and post-transaction integration, we offer hands-on guidance at every step. Our team ensures that your interests are represented, providing expert advice that allows you to achieve a smooth, successful transaction.

The Marketing Services industry is a dynamic and fast-evolving sector that continues to capture the attention of private equity firms. With its broad range of opportunities and high potential for growth, private equity investors see immense value in companies within this industry. Here are five key reasons why private equity finds the marketing services industry attractive:

As businesses across industries increasingly rely on digital platforms and data-driven strategies to reach consumers, the demand for effective marketing services has never been greater. Private equity firms are attracted to the industry because of its potential for long-term growth fueled by the increasing need for customer acquisition, brand positioning, and digital marketing expertise. As companies continue to shift their focus to digital and performance-based marketing, the industry’s future growth prospects remain strong.

The marketing services sector is highly fragmented, offering substantial opportunities for consolidation. Private equity firms are attracted to this fragmentation because it allows for scaling by acquiring smaller competitors and achieving operational synergies. By integrating companies with complementary services, private equity investors can build stronger, more competitive platforms with enhanced capabilities, leading to significant value creation through economies of scale and increased market share.

Many businesses in the marketing services sector, especially those involved in digital marketing, content creation, and software platforms, operate with recurring revenue models. These models provide predictable, steady cash flow, which is highly attractive to private equity investors. Additionally, businesses in this space often enjoy strong profit margins due to the low capital intensity of marketing services, offering high returns on investment for private equity firms looking for profitable growth.

The marketing services industry is a key player in the tech-driven transformation of the business world. The rapid adoption of new technologies, such as artificial intelligence, automation, and data analytics, has created tremendous opportunities for innovation. Private equity firms are drawn to businesses that can leverage cutting-edge technologies to optimize marketing campaigns, target audiences more effectively, and drive greater ROI. Companies that incorporate innovative tools and techniques are better positioned for future success, making them attractive investments.

The industry’s adaptability has been demonstrated through its responsPrivate equity firms invest in industries where there is a clear path to exit, and the marketing services sector offers a wealth of exit opportunities. These include strategic acquisitions by larger players in the marketing, technology, or media sectors, as well as public offerings for high-growth companies. Private equity investors are confident in the liquidity options available in the marketing services industry, which allows them to realize strong returns when they exit their investments.e to market shifts, such as the rise of virtual and hybrid events post-pandemic. The ability to pivot and innovate makes the sector resilient to economic cycles, an attractive feature for investors looking for long-term returns.

If you’re seeking to attract a private equity buyer to your Marketing Services business, understanding what investors are looking for is crucial. Private equity firms focus on businesses with strong growth potential, solid financials, and the ability to scale. Here are five key things you need to keep in mind to make your business appealing to potential private equity buyers:

Private equity firms seek businesses with well-defined, scalable models that can grow with additional investment. To attract buyers, ensure your marketing services business has a clear strategy for expansion, whether through increased market penetration, geographic diversification, or the addition of new service lines. A proven, scalable business model will make your company a more attractive investment opportunity, as private equity firms are often focused on accelerating growth.

Private equity buyers want to see a history of strong and consistent financial performance. Ensure that your business has solid financial records that show reliable revenue growth, healthy profit margins, and strong cash flow. By keeping track of your performance and demonstrating profitability, you increase the credibility of your business. Private equity investors are particularly drawn to businesses with predictable and recurring revenue streams, such as subscription-based services or long-term contracts.

A diverse and loyal client base is a key selling point for private equity buyers. Ensure your marketing services company has a broad range of clients to minimize the risks associated with customer concentration. Private equity investors prefer businesses with recurring contracts, as these offer predictable revenue streams. Highlight any long-term relationships with clients, especially those with annual retainer agreements or subscription-based services, as they provide stability and consistent cash flow.

The marketing services industry is heavily driven by technology and innovation, particularly in areas like digital marketing, data analytics, and marketing automation. To appeal to private equity buyers, make sure your business is integrating the latest technologies that drive efficiency, enhance client results, and improve operational performance. A company that stays on the cutting edge of digital marketing trends, adopts automation, and leverages data analytics will be seen as forward-thinking and poised for growth.

Private equity investors don’t just buy into businesses; they buy into people. Having a strong, capable, and experienced management team is crucial in making your business more attractive to private equity buyers. Show that your leadership team has the expertise and vision to execute on the company’s growth plans. Buyers want to know that your business can continue thriving post-acquisition with minimal disruption, so ensuring a strong leadership team is key to your business’s appeal.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.