The Advisory Investment Bank is recognized as the premier advisor for middle-market businesses in the MedSpa industry. Our deep expertise, strategic insights, and extensive network make us the go-to partner for MedSpa owners seeking to grow, consolidate, or exit their businesses.

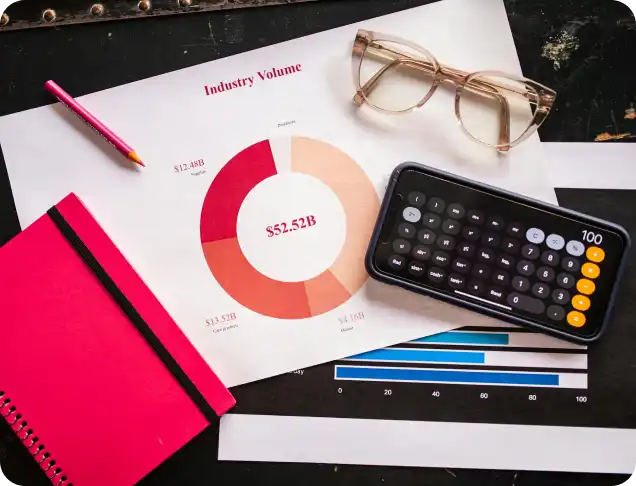

Check out our latest in depth report on your industry

We have a comprehensive understanding of the unique dynamics in the MedSpa sector, including:

Our knowledge allows us to craft tailored strategies that maximize value for our clients.

With a vast network of strategic acquirers and private equity investors actively seeking opportunities in the MedSpa space, we connect you with the right partners. Whether you’re looking to consolidate, scale, or exit, we ensure that your business is presented to buyers who understand its true potential.

We excel at identifying and showcasing the unique strengths of your business, such as:

By emphasizing these factors, we position your business as an attractive investment opportunity.

As a middle-market specialist, we design customized strategies that align with your specific goals and circumstances. Whether you’re planning to expand, seeking a strategic partnership, or ready to sell, our expertise ensures the best outcome for your business.

The Advisory Investment Bank has a history of successful transactions in high-growth, consumer-focused industries like MedSpa. Our process-driven approach ensures that every detail is managed, from valuation and buyer identification to negotiations and closing.

The Automatic Door Repair and Installation industry has emerged as an attractive sector for private equity investors due to its steady demand, technological innovation, and growth opportunities. Below are five key reasons why private equity firms are drawn to this dynamic industry:

Automatic doors require regular maintenance and compliance checks to ensure safety and functionality, leading to recurring revenue streams. This predictable cash flow from ongoing service contracts is a significant driver of investor interest, offering stability and long-term profitability.

The demand for automatic doors is increasing in industries such as:

The Automatic Door Repair and Installation sector is fragmented, with numerous small to mid-sized companies serving regional markets. Private equity firms are attracted to the potential for buy-and-build strategies, allowing them to consolidate smaller businesses into a scalable platform, achieve operational synergies, and create value.

Advancements in automation, energy-efficient systems, and smart technology have revolutionized the industry. Features such as IoT-enabled doors, touchless entry systems, and enhanced security integrations make this sector a high-growth market, appealing to private equity firms that prioritize innovation-driven investments.

The industry benefits from its essential nature, as automatic doors are integral to safety, accessibility, and compliance with regulations like ADA and fire codes. Additionally, retrofitting and upgrades of existing doors to meet modern standards create continuous demand, ensuring resilience even during economic downturns.

If you’re considering attracting private equity investment for your Automatic Door Repair and Installation business, it’s important to focus on key factors that drive value for buyers. Here are five things to prioritize to make your business more appealing to private equity investors:

Private equity buyers value businesses with predictable and consistent cash flow. To strengthen your appeal:

Investors look for businesses that have strong growth potential. To showcase scalability:

Private equity firms value businesses with efficient operations and solid financials. To optimize your position:

Businesses that embrace technological advancements are more attractive to private equity buyers. To stand out:

Private equity buyers want assurance that your business has the leadership and workforce to sustain growth. To address this:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.