The Advisory Investment Bank is the trusted partner for middle-market businesses in the Pest Control industry, offering unmatched expertise and proven success in navigating complex transactions. Our deep industry knowledge, strategic approach, and extensive network make us the go-to advisor for companies seeking growth, investment, or exit opportunities.

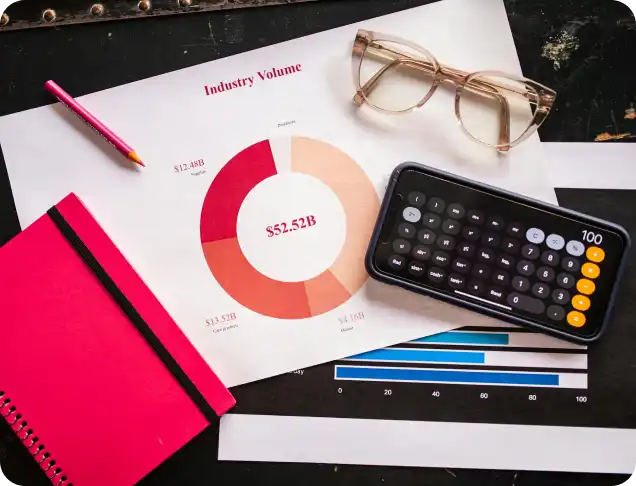

Check out our latest in depth report on your industry

We have extensive experience working with Pest Control businesses, from residential and commercial services to specialty pest management providers. We understand the industry’s unique drivers, including recurring revenue models, regulatory compliance, and increasing demand for eco-friendly solutions.

Our team specializes in identifying and highlighting the value drivers that matter most to investors and buyers:

By showcasing these strengths, we ensure your business attracts premium valuations.

We have cultivated relationships with private equity firms, strategic acquirers, and industry leaders actively seeking Pest Control businesses. Our ability to connect you with the right buyers ensures you achieve the best possible outcome, whether pursuing a sale, merger, or capital raise.

Our history of successful transactions in the Pest Control industry speaks to our expertise and ability to deliver results. We help clients navigate challenges, uncover growth opportunities, and achieve their financial goals.

Unlike larger investment banks that prioritize billion-dollar deals, we are dedicated to the middle market. We provide personalized service, tailored strategies, and hands-on execution to deliver exceptional results for businesses of your size.

The Pest Control industry has become increasingly attractive to private equity investors due to its steady growth, recurring revenue models, and resilience in various economic conditions. Here are five key reasons why private equity firms are actively investing in this sector:

The industry is experiencing consistent growth driven by increasing demand for live events, corporate functions, weddings, festivals, and experiential marketing campaigns. With the rise of hybrid events and innovative production technologies, the sector is evolving rapidly, creating opportunities for scalable business models that appeal to private equity investors.

Pest Control is considered an essential service, maintaining steady demand regardless of economic conditions. Whether for residential, commercial, or industrial clients, pest management services remain critical for health, safety, and regulatory compliance, offering resilience during economic downturns.

The Pest Control industry is highly fragmented, with numerous small to mid-sized operators serving local or regional markets. Private equity firms see significant potential for buy-and-build strategies, where they can consolidate multiple businesses to create larger, more efficient, and scalable platforms.

Private equity investors recognize the opportunity to drive growth by implementing:

These innovations not only enhance service quality but also create competitive advantages.

Rising urbanization, increasing health and safety regulations, and climate change have amplified the demand for pest control services across residential, commercial, and industrial sectors. This long-term demand, combined with attractive margins and low capital intensity, positions the industry as a reliable investment opportunity.

If you’re looking to position your Pest Control business for a private equity transaction, it’s essential to focus on the factors that drive value and attract investor interest. Here are five key things to keep in mind to make your business stand out to private equity buyers:

Private equity buyers are drawn to businesses with stable, predictable revenue streams. To enhance your attractiveness:

Investors seek businesses that can grow efficiently. Position your company for scalability by:

Operational improvements can enhance margins and profitability, which is a key focus for private equity firms. To streamline operations:

Pest Control businesses must adhere to strict environmental and safety regulations. To build investor confidence:

Private equity firms look for businesses with leadership teams capable of driving growth and managing operations post-investment. To strengthen your business:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.