The Residential Foundation Repair and Installation industry plays a critical role in maintaining structural integrity and addressing issues caused by aging housing stock and climate-related challenges. The Advisory Investment Bank is the trusted partner for businesses in this sector seeking strategic growth, investment, or exit opportunities. Here’s why we lead in this industry:

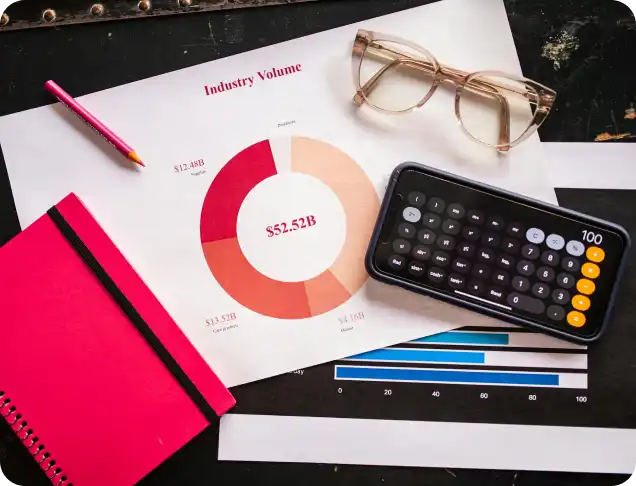

Check out our latest in depth report on your industry

Our team has deep knowledge of the unique dynamics in the foundation repair and installation market. We understand:

We have extensive experience successfully advising and executing transactions in the middle market. Our expertise ensures:

Our vast network includes private equity firms, strategic buyers, and institutional investors who are actively seeking opportunities in the Residential Foundation Repair and Installation sector. We connect you with:

We help businesses highlight their strengths and unlock value through:

At The Advisory Investment Bank, we prioritize your success beyond the transaction. Our advisory services focus on:

The Residential Foundation Repair and Installation Industry has garnered significant attention from private equity investors due to its essential nature and growth potential. Here are five key reasons why this sector is an attractive investment opportunity:

Foundation repair and installation are critical services that homeowners cannot delay when structural issues arise. Key drivers of steady demand include:

This non-discretionary nature makes the industry recession-resilient and provides stable revenue streams.

The foundation repair industry is highly fragmented, with numerous small, independent operators. Private equity sees:

Foundation repair services often command premium pricing due to their technical complexity and urgency. Investors value:

As climate change continues to impact homes and structures, demand for advanced, climate-resilient foundation solutions is rising. Private equity firms recognize the potential in:

The integration of technology in the foundation repair industry is creating new efficiencies and competitive advantages. These include:

If you’re looking to attract private equity investment in the Residential Foundation Repair + Installation industry, it’s essential to position your business as scalable, profitable, and operationally efficient. Here are five key factors to focus on:

Private equity buyers seek businesses with predictable and recurring revenue. To enhance your appeal:

Private equity firms are attracted to businesses that can scale effectively. Focus on:

A strong reputation for reliability and expertise is essential in the foundation repair industry. To make your business more attractive:

Private equity investors want to see strong financials that reflect profitability and growth potential. Focus on:

The foundation repair industry is evolving with new technologies and solutions. To stand out to private equity buyers:

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.