At The Advisory Investment Bank, we specialize in providing strategic investment banking services to businesses in the Vitamin & Mineral Supplement industry. Our deep expertise, track record of success, and personalized approach make us the go-to partner for middle-market companies seeking to unlock their growth potential and secure optimal investment outcomes. Here’s why we’re recognized as the leading advisor for businesses in this space:

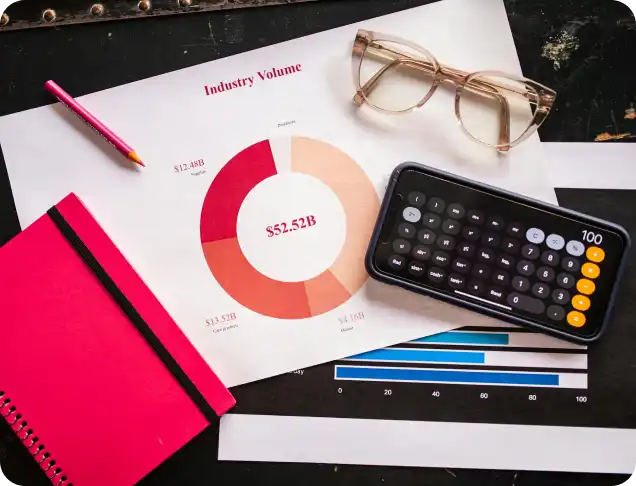

Check out our latest in depth report on your industry

With years of experience in the Vitamin & Mineral Supplement sector, our team has developed a deep understanding of market dynamics, consumer trends, regulatory challenges, and growth opportunities. Whether you are a manufacturer, distributor, or a retailer, we have the insights needed to navigate the evolving landscape and offer tailored strategies that maximize your business value.

The Vitamin & Mineral Supplement industry has seen a steady increase in consumer demand due to the rising awareness of health and wellness. At The Advisory Investment Bank, we focus on high-growth market segments such as organic supplements, personalized nutrition, and clean-label products. Our in-depth knowledge of these expanding niches allows us to connect businesses with private equity and strategic investors looking for high-potential opportunities in this thriving sector.

We have a proven track record of facilitating successful mergers and acquisitions, capital raises, and strategic partnerships for companies in the Vitamin & Mineral Supplement industry. Our extensive network of investors and strategic buyers enables us to secure the best possible deal for our clients. Whether you are looking to sell, raise capital, or form a partnership, our team has the expertise to guide you through each step of the transaction process.

We understand that each business in the Vitamin & Mineral Supplement sector has unique challenges and opportunities. At The Advisory Investment Bank, we take a personalized approach to every engagement, crafting investment strategies and transaction structures that are aligned with your specific business goals. From capital raising and debt financing to navigating the complexities of M&A transactions, we provide bespoke solutions designed to meet your business’s unique needs.

At The Advisory Investment Bank, our focus goes beyond the transaction. We strive to build long-term relationships with our clients by providing ongoing support and value throughout the life cycle of your business. From advising on growth strategies to connecting you with key industry players, we are committed to ensuring the continued success of your business long after the deal is closed.

The Vitamin & Mineral Supplement industry has become an increasingly attractive target for Private Equity investors. With growing consumer demand for health and wellness products, advancements in technology, and evolving market trends, private equity firms are keen to invest in companies within this space. Here are five key reasons why Private Equity finds this sector so appealing:

The demand for Vitamin & Mineral Supplements has surged due to a heightened awareness of health and wellness, with consumers becoming more proactive in managing their personal health. The rising adoption of preventative healthcare, aging populations, and increased interest in fitness and mental well-being all contribute to the industry’s robust growth. Private Equity investors see significant long-term growth potential in this sector, driven by the ongoing consumer shift towards healthier lifestyles.

The industry is highly innovative, with companies continuously developing new products and formulations to meet evolving consumer preferences. Private Equity investors are particularly attracted to businesses that focus on personalized nutrition, organic and natural supplements, and clean-label products. These innovations offer substantial growth potential, and private equity investors are eager to support businesses that are poised to lead in these emerging trends.

Many companies within the Vitamin & Mineral Supplement industry benefit from high gross margins, driven by relatively low production costs and strong brand loyalty among consumers. Additionally, the growing popularity of subscription-based services for supplements offers companies the ability to secure recurring revenue streams. This combination of strong margins and predictable revenue models makes the industry particularly attractive to private equity investors seeking stable and lucrative returns.

The Vitamin & Mineral Supplement market is highly fragmented, with numerous small and medium-sized businesses operating across various product categories and geographic regions. This presents attractive consolidation opportunities for private equity firms. By acquiring and integrating smaller players, private equity investors can drive synergies, expand market reach, and achieve economies of scale. As a result, there are ample opportunities for value creation through strategic mergers and acquisitions.

The Vitamin & Mineral Supplement industry has demonstrated resilience even during economic downturns. Consumer demand for health products tends to remain steady or even increase during times of economic uncertainty, as people prioritize their well-being. This stability makes the industry appealing to private equity firms looking for investments that can weather economic cycles and continue generating strong returns, regardless of broader market conditions.

To attract a Private Equity (PE) buyer, businesses in the Vitamin & Mineral Supplement industry must demonstrate a strong, scalable model and provide clear opportunities for value creation. Private equity investors are looking for businesses that can generate consistent growth, offer operational efficiency, and create long-term value. Here are five key factors to keep in mind when preparing your business for acquisition by a private equity firm:

Private equity buyers seek businesses with solid financials and consistent revenue streams. To attract PE interest, your company must have a proven track record of profitability, strong cash flow, and the ability to scale. Ensuring your financial statements are accurate, transparent, and free of significant liabilities will build confidence in potential buyers. Additionally, having clear financial projections with well-supported assumptions will showcase your company’s growth potential.

In the Vitamin & Mineral Supplement industry, brand reputation and customer loyalty play a pivotal role in a business’s long-term success. PE investors are attracted to businesses with strong, trusted brands and a loyal customer base. By building a recognizable brand and developing customer-centric marketing strategies, your company can demonstrate its potential for sustaining or increasing market share. Highlighting repeat customers, high retention rates, and positive reviews will further reinforce your brand’s value proposition.

PE investors look for businesses with unique value propositions that stand out in a crowded market. Focus on how your product offerings differentiate from competitors—whether through innovative formulations, organic or clean-label ingredients, personalized nutrition, or advanced delivery technologies. Offering products that tap into emerging trends such as sustainability, personalized health, and wellness can be a major draw for PE investors. Showcasing how your product portfolio is adaptable to evolving consumer preferences will position your company as a future-proof investment.

PE firms value businesses with efficient operations that can scale with minimal additional investment. Whether it’s through supply chain optimization, automation, or cost-effective manufacturing processes, demonstrating how your company operates efficiently will make it more attractive to potential buyers. Ensuring you have strong, scalable operations in place that can handle increased production and distribution as demand grows will help investors see your business as a low-risk opportunity for growth.

Private equity investors are often attracted to businesses with significant opportunities for growth through mergers and acquisitions (M&A), or expansion into new markets. The Vitamin & Mineral Supplement industry is highly fragmented, and PE investors often look for consolidation opportunities. Highlight any potential acquisition targets, partnerships, or geographic regions where you can expand. Whether it’s diversifying your product range, entering new retail channels, or scaling globally, outlining clear avenues for growth will make your business more appealing to a private equity firm.

Let’s discuss your unique opportunity. Speak with our team for a complimentary consultation.

Securities are offered through Finalis Securities LLC Member FINRA / SPIC. The Advisory IB is not a registered broker-dealer, and Finalis Securities LLC and The Advisory IB are separate, unaffiliated entities. theadvisoryib.com (the “The Advisory IB” Website) is a website operated by The Advisory IB, a privately held Delaware incorporated limited liability company. The Advisory IB provides financial and strategic advisory, consulting services, mergers and acquisitions services, and fairness opinions. *”Featured Transformations” portion of this website is representative of past businesses and clients that our team has been involved in outside of The Advisory IB Inc.

© The Advisory IB Inc. All Rights Reserved.